A career (or even a side-hustle) in photography can be exciting. Read on for some helpful beginner’s information.

A career (or even a side-hustle) in photography can be exciting. Read on for some helpful beginner’s information.

There are a whole host of specialised styles of photography that often individuals are unaware of, and so this article will depict those styles to give you a helping hand.

Wildlife photography:

This is an extremely challenging form of photography, whilst it may be exciting and intriguing this can often be overtaken by the element danger of terrible conditions. You need to fully understand the animals or the life forms you are taking pictures of in order to aptly portray their habitats and their way of life. It can in fact take many days before you get the perfect shot so you need patience.

Landscape photography:

The most important aspect of landscape photography is finding the perfect spot to take your image, this form also requires patience as weather and alike can often disturb proceedings.

Sports events:

In order to take pictures of sporting events you need to have a knowledge of the sport you are shooting in order to be aware of when to take images and what shots will be most appreciated by viewers.

Photo journalism:

This is completely different to other forms as it requires the photographs to tell a story through visuals, which can be extremely difficult. The person viewing needs to fully understand a story via the view of one mere image.

Fashion pictures:

Fashion pictures:

Fashion photographers need to have a creative and innovative eye, they need to think outside of the box. This form of art absolutely has to be original in order to be considered good.

Black and white treatment:

This can add a unique edge to images and can be extremely rewarding yet it requires an intricate process which must be mastered.

Shooting celebrities:

This can be an exciting job as you get to see famous individuals, yet it is very difficult and high pressured because you need to get a photograph of people who are quite often trying to avoid you. You have to plan ahead for all possible outcomes when attempting to shoot famous people.

What do you need to start your business?

Photography is a fantastic and intriguing form of art and so it is no surprise that so many people seek to participate in it. However, many individuals have trouble when it comes to branching out on their own and starting their own photography business.

As is the case with any business; research is absolutely essential. Before you even consider setting up a photography business you must partake in an extensive amount of research in order to make sure you are fully prepared and know what to expect from the industry you are diving into.

You will also need to decipher which location you will reside your business in. When a photography business is first starting out it must have an assured and settled location in order to proceed and move forward in the future.

If you want to be successful in your photography business then you absolutely must have a credible and impressive portfolio. No one is going to book you if you do not have a wide range of examples of your photography work. An impressive portfolio will instantly gain you the desired amount of customers you require. Try and make sure you have a wide range of various shots; thus displaying your skills, don’t keep every single photo you have ever taken as this will bore the viewer.

An attractive and striking business card is a must; make sure all your details are included yet do not overload individuals with irrelevant information. Your email must be easy to remember and easy to read, so keep it sweet and simple. There are so many business cards that have the company name and the picture extremely large whereas the actual contact information is tiny. Don’t do this – make sure your telephone number is the largest thing on the card.

Finally, an effective marketing strategy is an absolute must. Especially in this current economic climate where competition is rife. Make sure you advertise your skills to the best of your ability and take advantage of the exposure the internet has to offer.

How much should you charge?

How much should you charge?

Deciding how much to price your photographs at can be a difficult decision as there is no ‘fixed’ valuation or even loose guidelines to give you a rough idea of what you should be charging. In reality the ideal price is the monetary sum the consumer is willing to pay matched with the price you are willing to sell at; yet reaching this point can be easier said than done. To give you a helping hand here are a few things to consider whilst pricing your photographs;

LOOKING FOR PRICING INFORMATION

Photographer’s Market:

This is a book published on an annual basis which includes an array of listings stating types of photos used and approximate price range paid. It is advisable to take a look at the Photographer’s Market merely to get a good idea of what others are charging.

Free Online Pricing:

Free online pricing websites are highly utilised but my advice is to be careful because the figures you get from various websites fluctuate massively.

FACTORS WHICH CAN ALTER YOUR PRICE

FACTORS WHICH CAN ALTER YOUR PRICE

Licensing:

The rights the purchaser requires is one of the most influential pricing factors. The level of rights you sell can highly increase the money you receive. Do your research on the variation of licensing terms available before you offer your photograph to someone, as you could be missing out on something substantial.

Your equipment;

This depends on the style of photo you take and whether you shoot in a studio or on location. Also, individual factors, such as whether you need to wear glasses matter, as they add to your budget. This website can assist with the latter.

The Buyer:

As is to be expected; each and every buyer has a different way of negotiating and a different belief of how much they should pay for your photograph. Remember to behave in a professional manner at all times and adjust your negotiation technique in relation to the individual or group you are dealing with.

You;

The final factor is of course; you. Only you can determine how much you are willing to sell your work for; can you afford to knock back an offer in the hope of a better one? Is photography your way of earning a living or merely a hobby?

Being on the other side of the camera

If you have been wanting to make a name in the modelling industry, you really need to have great headshots that you can send out, to tell you the truth, making a full portfolio is very advisable.

A model has to find a photographer and a location where they’ll be able to take good headshots or even a complete portfolio. When, for instance, you want your headshot or portfolio to be taken with a natural background, you can hire a photographer and try finding a location ideal for the concept you want. As another option, you can try doing the shoot in a studio where restrictions on time are lower and you can adjust the lighting without too much difficulty.

Also, one of the best things you will experience when you hire a photo studio is being able to consult their resident photographer. A photographer knows his or her expertise very well and also the ways on how you can make the most of the studio rental.

In the last year alone, about 642,000 people moved to the UK. While the COVID-19 pandemic has changed some people’s plans about moving, the desire is still there for those who are interested.

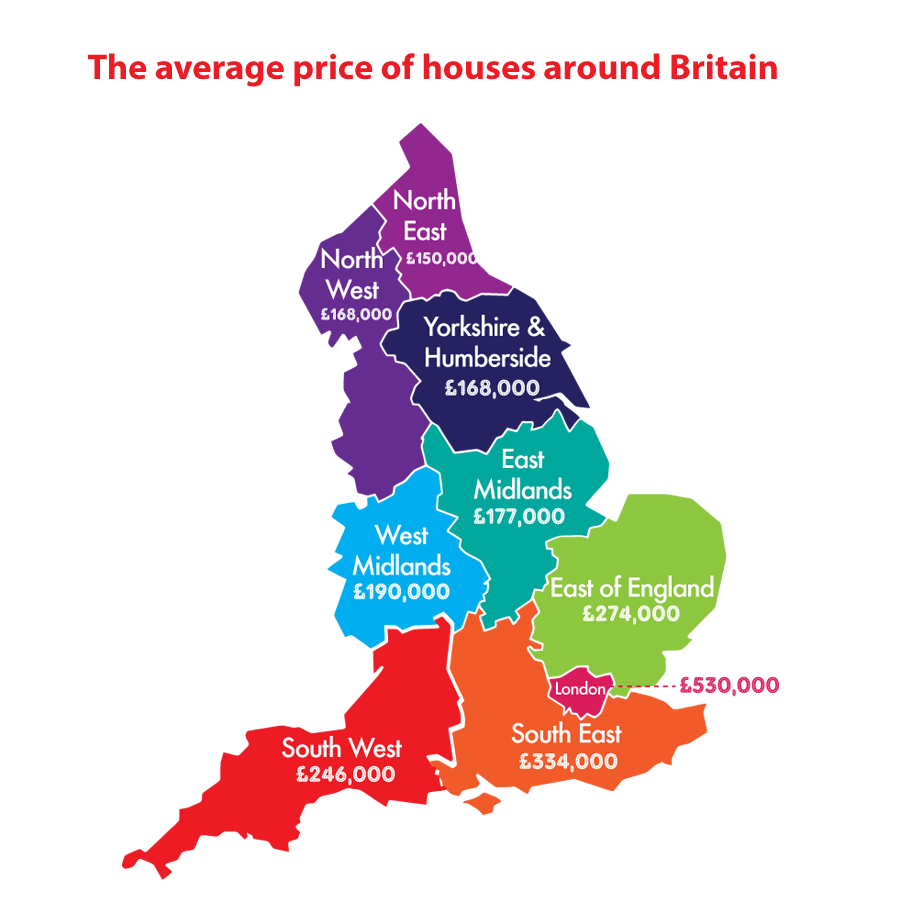

In the last year alone, about 642,000 people moved to the UK. While the COVID-19 pandemic has changed some people’s plans about moving, the desire is still there for those who are interested.  Property investments can be highly profitable and present a stellar way of growing your finances. The underlying benefit of property investments is that houses rarely decrease in value. If you looked at a chart over the last couple of decades, you’d notice that house prices generally go upwards. There are dips – like during the financial crisis – but in the past they have tended to end up levelling out and going up. This makes property a rare investment as you’ve almost certain to see long-term gains. Compare it to investing in stocks/shares; businesses can easily close down or be embroiled in a major scandal. As a result, your shares can plummet in value and leave you with nothing. This will never be the case with a property investment!

Property investments can be highly profitable and present a stellar way of growing your finances. The underlying benefit of property investments is that houses rarely decrease in value. If you looked at a chart over the last couple of decades, you’d notice that house prices generally go upwards. There are dips – like during the financial crisis – but in the past they have tended to end up levelling out and going up. This makes property a rare investment as you’ve almost certain to see long-term gains. Compare it to investing in stocks/shares; businesses can easily close down or be embroiled in a major scandal. As a result, your shares can plummet in value and leave you with nothing. This will never be the case with a property investment! Credit score

Credit score Your employment status

Your employment status There are some investments that

There are some investments that  But what does the pandemic mean for those who are hoping to invest in real estate? Does it mean that their plans will need to go on hold until a vaccine is developed and life can return to normal? Does it mean that investors should look to overseas markets where the pandemic has created less instability? Or does it mean that investors’ interests would be better served by looking elsewhere? Whether you’re buying an investment property, diversifying your retirement portfolio or simply looking for a new home for your family, you need to know how the current changes to the real estate landscape affect you.

But what does the pandemic mean for those who are hoping to invest in real estate? Does it mean that their plans will need to go on hold until a vaccine is developed and life can return to normal? Does it mean that investors should look to overseas markets where the pandemic has created less instability? Or does it mean that investors’ interests would be better served by looking elsewhere? Whether you’re buying an investment property, diversifying your retirement portfolio or simply looking for a new home for your family, you need to know how the current changes to the real estate landscape affect you. Are people still buying and selling real estate?

Are people still buying and selling real estate? So, what’s changed

So, what’s changed Will property prices fall?

Will property prices fall? The interest rates rollercoaster and what it means for you

The interest rates rollercoaster and what it means for you You’ve decided to invest your money in real estate, which is potentially a wise move. Even if the market value drops, there are options other than selling and trying to break even. Many property owners keep hold of their investments for years, renting them out to cover the mortgage, until the sector recovers.

You’ve decided to invest your money in real estate, which is potentially a wise move. Even if the market value drops, there are options other than selling and trying to break even. Many property owners keep hold of their investments for years, renting them out to cover the mortgage, until the sector recovers. Whether it’s a holiday house or a business proposition, it’s better to look farther from home. Thailand is and has been popular with British citizens and expats for years, but what makes it an ideal investment opportunity?

Whether it’s a holiday house or a business proposition, it’s better to look farther from home. Thailand is and has been popular with British citizens and expats for years, but what makes it an ideal investment opportunity? Tax Loopholes

Tax Loopholes The Lifestyle

The Lifestyle A career (or even a side-hustle) in photography can be exciting. Read on for some helpful beginner’s information.

A career (or even a side-hustle) in photography can be exciting. Read on for some helpful beginner’s information. Fashion pictures:

Fashion pictures: How much should you charge?

How much should you charge? FACTORS WHICH CAN ALTER YOUR PRICE

FACTORS WHICH CAN ALTER YOUR PRICE The investment world tends to go through various fads, perhaps most recently seen with the rise and fall of

The investment world tends to go through various fads, perhaps most recently seen with the rise and fall of  Bullion / Gold

Bullion / Gold Once the kids have flown the nest, and you and your partner are happily retired (or at least approaching retirement), it’s time to start

Once the kids have flown the nest, and you and your partner are happily retired (or at least approaching retirement), it’s time to start  Do Not Get a Storage Unit

Do Not Get a Storage Unit  Inform The Right People

Inform The Right People Keep Renting

Keep Renting Binary options robots are one of the most popular choices for those new to trading. These robots can give binary options traders a way into the market without having to know too much about it. This can be incredibly useful for those wanting to get started but not knowing where or how to start.

Binary options robots are one of the most popular choices for those new to trading. These robots can give binary options traders a way into the market without having to know too much about it. This can be incredibly useful for those wanting to get started but not knowing where or how to start.  As a beginner, you need to be cautious about how you find your robot. There are plenty of sites on the internet that will flag up suspect robots and if you need to deposit money into your account before you’re allowed to see the features of the automated trading robot, this should also be a red flag for you. Be cautious and you will make some money from binary options trading.

As a beginner, you need to be cautious about how you find your robot. There are plenty of sites on the internet that will flag up suspect robots and if you need to deposit money into your account before you’re allowed to see the features of the automated trading robot, this should also be a red flag for you. Be cautious and you will make some money from binary options trading.  My first ever car

My first ever car