Last week’s post exploring a house as a asset caused an interesting stir in the comments and I thought it definitely worth-while exploring it further as I make the case to find space in your budget for investing before showing you how to actually do it!

We all have only so much money to spend each month. Food, utilities, shelter and a host of other expenses all come out of accounts and sometimes it’s a balancing act to afford everything we need and want. So when it comes to growing your pennies the first challenge to having enough to live the life you want to lead and have any left for the future. One big monthly expense that can make or break your financial life is your housing. Naturally then, it’s a topic worth exploring if you are to successfully grow your pennies in the best way that works for you.

‘Real Estate’: Britain Vs US

‘Real Estate’: Britain Vs US

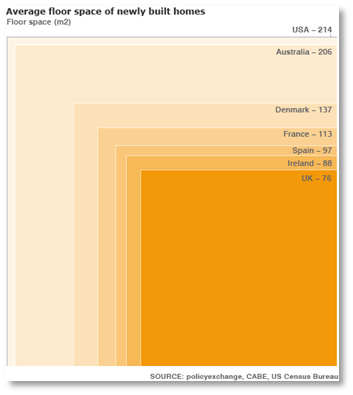

‘Real Estate’ is an America term for housing property and land. And in the UK we have less of it than larger countries like the US. As Britain is a tiny island and a growing population our land therefore comes at a premium. When it comes to Real Estate this means that most US houses are cheaper per square metre, but also are larger than most British houses – although this is not hard as, according to the government’s adviser on architecture, Britain has the smallest newest built houses in Europe. Therefore for a comparable home UK houses are generally more expensive than in America.

The rush to being ‘priced out’

I make reference to this because with more expensive housing already and house prices in the UK growing considerably over the last few decades it’s a wide-spread belief certainly amongst my friends that you should get on the housing ladder as soon as possible to avoid being ‘priced out’ of the market.

“We surely must buy now before house prices rise further and become truly unaffordable”

This rush to buy has lead to some interesting demographic patterns as explored by a study by the Institute for Fiscal Studies in University College, London:

“As a proportion of their total wealth, British households hold relatively small amounts of financial assets – including equities in stock – compared to American households. In contrast, British households appear to move into home ownership at relatively young ages and a large fraction of their household wealth is concentrated in housing. Finally, the age gradient in home equity appears to be much steeper in the UK while US households exhibit a steeper age gradient in stock equity.”

You can read the full study here

A Cultural Difference?

This conclusion certainly seems to be case amongst my peers. As I prepare to enter my mid 20s more and more of my friends are moving towards home-ownership yet I don’t know a single one of my peers who own any stocks or shares (but I can’t wait to inform with Magical Penny!) In contrast, Americans begin to invest earlier and in greater number, and it is generally before progressing to home ownership. The study reveals a telling statistic:

“British households hold 62% of their total household wealth as home equity: the comparable percent for American households is only 34%.” Page 7

This is partly because British houses are more expensive but I suspect too that the culture of investing in equities (stocks and shares) is much bigger in America than in Britain. By investing in stocks and shares a larger proportion of the US population are putting their money into value-creating businesses of the biggest economy of the world, thus, over the long-term they are accumulating market returns, growing their pennies into surprisingly large sums.

Britons meanwhile have almost 2/3 of the wealth in property, which, while having the ability to grow in value, also has added costs and fees like maintenance, repair and stamp duty (the tax paid every time a house is purchased).

The Right Priorities?

The study found that:

“for almost all of the younger age-income groups UK households have at least as much wealth, if not slightly more, than their US counterparts…[yet looking across the full population] the top fifth of American households have considerably more financial wealth than the top fifth of British households do [?] page 8.

Why do British and American age-income groups start out equal but then begin to divide? Is it because the Americans have more likely invested their money into value-creating businesses rather than property?

To be frank, I can’t be sure as there’s many factors involved. But I do think more of us should be directing own pennies to build different asset classes (types of investment) rather than focusing so much on purchasing a house.

To be frank, I can’t be sure as there’s many factors involved. But I do think more of us should be directing own pennies to build different asset classes (types of investment) rather than focusing so much on purchasing a house.

What this mean if you want to grow your pennies?

In real terms for me this means saving less aggressively for a house deposit (although I still am) by directing part of my ‘savings’ pennies into stock market investments for my long-term future. We all have only so much money to spend each month but balancing your budget to include a monthly contribution towards ‘investing’ is absolutely a ‘need’ if you truly do want to grow your pennies over the long-term (and Magical Penny will be here to show you how).

What you do you think?

Before you comment I want to remind you that this article is not saying property is a bad investment – like any investment it can be both good and bad -but that the view that property should be your first financial priority should not simply be accepted: It may be the ‘default view’ of many people when they begin their adult lives but have you really considered your options?

Essential reading:

- Ramit cuts through the myths that buying a houses is always a good thing to do. You can even his chapter on the subject from his book for free too: Buying a House

- Is “What Works For You” really working? @Magical Penny

- Your Home is not an Investment@Magical Penny

{ 14 comments… read them below or add one }

I like the article but there is a foundational numberwang I can’t understand.

Person A and Person B have £1’000 to spend between housing and investments.

Person A spends £500 on a mortgage and puts £500 into a stocks and shares ISA.

Person B follows the idea of not buying a house immediately and rents, thus costing more per month for the same lifestyle as person A. Person B puts £600 into rent and £400 in a stocks and shares ISA.

Person A see’s their £500 mostly go to the bank in interest but also notices a slow but growing monthly amount that actually pays for their house. They also have £100 more than person A going into stocks and shares.

As long as Person A didn’t buy a house that needed extensive work Person A clearly would be the better off.

What i’m arguing is essentially, if buy yourself affordable accomodation there is nothing stopping you from putting more money into savings than those who don’t buy.

I am excited about your investment information as I may come over to the dark side and open up a Stocks and Shares ISA following your information.

American real estate has hardly been a shining light to the world. Look at their foreclosures compared to the UK, which has cooed quite well with avoiding reposession compared with the early nineties.

This begs the question, if Americans save so well, why do they need more 100% mortgages? I’m sure the top percentile get very wealthy, but the UK model has held up better. The downside is this encourages house price inflation even more.

The fundamental difference between the UK and US housing marking is that, US houses may be bigger but they are not built to anywhere near UK or even european (preferably german) standards. So they pay less for a bigger, less efficient house. However, their energy is cheaper so it doesnt cost as much to waste energy however, when energy prices rises exponentially, who’s in a better position. US with a big, drafty house to heat, or the Uk with smaller, more energy efficient housing? One reason why its a good idea to buy a house is that rented accomendation may be terribly energy inefficent. The landlord wont upgrade any insulation due to the fact any cost saving on utility bills is passed on to the tenant. Owning your own property allows for upgrades to be made which also pass savings on to the owner/occupier.

A friend of mine did some back of beer mat stats. The FTSE has risen by approx 577% since 1984, whereas the UK housing marketing has only risen 504%. Looks like investing in the FTSE would’ve been the best option, but as you can’t live in the FTSE-linked product you buy you’d have to rent or buy housing.

My own quick review on house maintenance costs show that an owner should expect to appoximately spend 1% of the houses value each year on maintainence. This cost changes the landscape when comparing cheap mortgages against expensive rent. However, rents already include this cost + an additional management fee.

I can’t help but conclude not just personally, but in my opinion the best for all would be to buy property as early as possible, as long as it is AFFORDABLE and save into stocks and shares; surely a brilliant middle ground between idealogies? Somewhere in the midatlantic?

Okay Adam. Here’s the crunch question. Give me a suitably considered answer on this, and you might be vindicated in your views:

If the power of the Market is so strong. If stocks and shares are such a solid, dependable, returnable investment. If the housing Market is so fickle, difficult and unreliable. And if we’d all be better having money in shares than bricks. Then why oh why were endowment mortgages such an idiotic, disreputable and unspeakable failure? Correct me if I’m wrong, but with those aren’t you just paying off a mortgage by investing in the Market?

I await an answer with interest (pun intended).

Actually! Mr Casey has a f a n t a s t i c point.

The first fourteen months of my working life was spent in an Endowment Mortgage complaints department. I eagerly await your response.

I’ve said it before, and I’ll say it again, 577% doesn’t mean so much when you put it all back in and hit bad times.

Very careful investing may provide a workaround for a long term solution (but not a main source of saving, IMO), but I think there is a reason global clearing banks work on ludicrously short timescales when covering their balance sheets. And Messers Goldman and Sachs couldn’t even pull that off so good. Dad’s second favourite group of friends to console (after the annuity pension holders) are our endowment mortgage holding friends.

@Spencer -thanks for your comment. I understand your determination. Just start small and don’t worry about the interest rate for now. Sooner than you think you’ll have enough savings to begin investing (assuming you have some emergency money). Magical Penny will be detailing the investment route shortly.

@Rightly Knightly -let’s play numberwang!

Only joking.

Firstly, we live in unusual times so at the moment its not that difficult to find a cheap place to rent putting into question your assumption that renting costs more per month for the same lifestyle as person A (in a house).

This ignores basic psychology -when you own your own house it takes tremendous discipline not to spend money improving it and making it your own -this is not wrong, in fact you would end up with a lovely house. But it would cost you more than you might think if you factor in what you’re missing in potential investment returns (again not that this is wrong, but just so you’re aware).

Ultimately I agree with you that property is best over the long term because you eventually build equity in a house giving your security and freedom. But property only really gives a good return over the long term so I’m questioning if it’s a good move considering most 20 somethings (my readership) will not be staying in the same house more than a handful of years.

@Jon: very true. You’re right about the topsu[percentile complicating things. To address your other point, the supposed appeal of 100% mortgages is that you can keep more of your wealth in the stock market (or consumer goods!) instead of your pennies being ‘stuck in house equity’ (quite risky but heady wreck-less optimism is fun to watch :))

@Sam, this is a brilliant comment thanks -I hadn’t thought about it that way.

Owning your own home means you’ll take more pride in everything and have motivation to make your home energy efficient. That said owning your own property may also mean you could over-spend (as explained in my response to Rightly Knightly above).

Long term though, you’re right: owning your home and making it energy efficient saves you more money than you would expect and is often worth the up-front cost…but would you expect to live in a house long enough to recoup the investments? I imagine most 20 somethings won’t.

@Sean. Brilliant question about endowments. Let me know if I am vindicated when I’m done OK?

Firstly for readers who don’t know what Sean is saying:

There are two basic types of mortgage. The first is a repayment mortgage, where you make one monthly payment to the lender which is part interest and part repayment of the original capital.

Basics of endowments

Then there are interest-only mortgages, where your monthly payment to the lender is just the interest on the original loan and the mortgage debt remains unchanged. You then make separate payments into an investment scheme (such as an endowment), with the idea being that at the end of the mortgage term this investment will have grown sufficiently to repay the mortgage.

Interest-only endowment mortgages were very popular in the 1980s and 1990s and were often chosen in the belief that the endowment would end up being large enough to clear the mortgage and still leave a tidy sum of money left over as a bonus.

Judging from some of my writings about market returns Sean is forgiven in thinking I may be a proponent of this view: i.e. why put money into property when you can invest it?

However… here’s why endowments failed and why the Magical Penny strategy I’ve been arguing is different:

“Endowments” as a product were aggressively marketed to everyone, with huge fees paid to ‘advisors’ on commission. This money didn’t come from no-where- it came from the payments that endowment policy holders paid. This ate into the returns.

You don’t know this yet but Magical Penny investment philosophy specifically seeks to avoids such fees.

Stocks and shares can be “solid, dependable, returnable investment” and over the long term history it has been shown they are. But towards the end of any investment horizon they require careful management of risk (i.e. getting out of them gradually in case the market dips when you need them.)

However, for endowment products the investments were often ‘black-box’ products that people didn’t understand -and they were not adjusted for risk as the mortgage term approached- leaving many with shortfalls when the market went through one of its volatile periods in the early 90s.

These days you can have much more control over your investments and have an opportunity to develop a greater understanding. However that is not to say that when you do eventually get a house that you should not pay it off:it really makes sense to build equity in a house because if you do need to move for any reason (family/job etc) the equity gives you flexibility and security (and a warm fuzzy feeling :)). If you had all your funds in the market instead of equity you might get ‘stuck’ if you are unhappy with current stock valuations when you needed to move or need to pay on the mortgage for any reason.

-end-

There you go Sean, practically a whole blog post in itself but I hope I’ve made a few points a bit clearer.

I don’t have all the answers though so appreciate the comments -it gets everyone thinking (rather than sticking to preconceived notions of ways to get property or equity riches). Phew…

Buying a home can sometimes be more of a liability than an asset. Obviously it depends on a number of factors but far too many people get in over their heads. That’s fairly clear with the amount of foreclosures we have seen over the past few years. One of the most important tips on budgeting I followed when I was young was that buying a house really isn’t an investment unless you are renting it out. I find it funny when people say ‘My house has gone up in value by 20% in the past 3 years!” The thing they don’t realize is that if your house goes up in value but so is every other house around you. If you sell you still have to buy something to live somewhere. It’s all relative.

Thanks for the post!

Conrad

http://howtomanagemoneytips.com/

I think it is also important to realise the added expenses owning property brings to the table when you decide if it is the right choice for you. Also, as we have seen, aren’t housing prices starting to go down a bit due to the economy?

I believe your chart is outdated. From what I understand, Australia has now overtaken the U.S. for having the largest average house size. Houses in the U.S. are shrinking back down towards 2,300 sqaure feet. Great post by the way.

@Rightly Knightly

“The FTSE has risen by approx 577% since 1984, whereas the UK housing marketing has only risen 504%.”

This is not a useful comparison at all. What if you put 10% down on the house? Your ROI may be nine times the return from the FTSE. Of course there are other factors such as taxes and maintenance. But, purchasing a home, if done properly, can be a great investment.

I wouldn’t compare endowment mortgages to the returns you could expect to get from sensible investing.

I’d compare endowment mortgages to the returns you could get if you respond to a Nigerian fraudsters £20MILLION OPPORTUNITY!

Okay, I exaggerate a bit, but the financial services industry has found 1,000 ways to extract money out of useful investments and make them work for them, not their customers.

They do it all the time with shares — endowments were their move on bricks and mortar! 🙁

Monevator, I love this comment and so so true.

There’s so many products available that take a good idea and then try to ‘add value’ (if you’re being nice) or, if you’re more cynical, try to as you say ‘extract money’ out of your pockets.

Thanks for stopping by -I’m a big fan and regular reader of your blog.

Bret and Kate,

Thanks for your comments too.

Buying a house can be great as it gives you leverage but if it’s not the right time for you, then it can be bad as it gives you leverage!

My point was not to think of buying a house as automatically the best thing to do.

You must log in to post a comment.

{ 3 trackbacks }