If your life is anything like mine it’s busy.

If your life is anything like mine it’s busy.

There’s not enough time in a day to do everything.

We have to prioritise everything we do; we do it thousands of times a day, and ultimately prioritisation defines our lives: having a firm grasp of what should or should not be prioritised is an integral part of success.

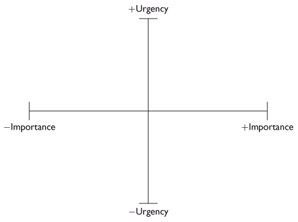

The Prioritisation Matrix

The number of decisions we make every day is huge and our brains are looking to make the optimum choice. When we are prioritising we are often weighing up the task using two metrics: importance and urgency.

- How important is the task?

- When does it have to be done by?

- What are the implications if we don’t do it right now?

In my day to day life, prioritisation is incredibly important in ensuring all my projects are being completed in the right timescales. In fact being really busy currently at work is what inspired this post.

But such prioritisation should not limited to our day jobs. It needs to be applied to everything that we want to succeed at, including our money habits.

More Money Through Prioritisation

The way we prioritise our spending can define a great proportion of our lives.

Ask yourself:

- Are you spending everything you earn every month?

- Is your money always being spent on things you need urgently leaving you with little else?

- Are you doing anything significant with your earnings?

If you want to grow your pennies successfully it might help to think about your saving and spending through the lens of the prioritisation matrix.

Urgent + Not Important

How much do you spend in an average day? Perhaps you buy lunch or coffee. Or pick up a newspaper and some gum. We may feel we need these purchases to help us through the day (the immediacy of such purchases makes this ‘Urgent’) but it is not the kind of spending that is ‘important’ in the larger context of life. We don’t need to buy newspapers or chocolate bars in the same way as we need to pay the electricity bill.

Small incidental purchases are sometimes necessary but if you’re not conscious about the amount you are spending, it can add up to a sizable sum over the course of a week or a month.

In the same way that urgent but unimportant tasks can interrupt workflow, making small incidental purchases can distract us from our spending budgets and stop us from reaching our saving goals.

I’m not immune from these spending distractions –since my place of work has reintroduced a deli bar, I’ve found my incidental spending sky-rocket: a bacon sandwich here, a milkshake there, and before I know it I’ve exceeded my food budget for the month.

The key is the recognise where you are spending money every day and keep it in check –spending money isn’t bad in itself but spending without thinking about it can prevent you from being able to spend on the important things that really matter to you.

Urgent + Important

Regular payments like a mortgage or rent, and the utilities are examples of urgent and important spending. The payments are frequent and very time specific, so are ‘urgent’ whilst having a roof over your head is seen by most as being rather ‘important’.

Paying for shelter is one of the most important things you do but are you paying too much?

If you are finding it hard to save money each month it may be because you are spending a lot on meeting your basic needs.

The less you spend on the basics the more you can save and the more you can spend on the things that matter for you. Selling your gold jewellery to reputable gold buyers can also be a practical solution if you’re facing financial challenges and struggling to make ends meet. Gold has intrinsic value, and by selling unused or unwanted jewellery, you can access quick cash to cover essential expenses.

It is much easier to grow your pennies if your urgent and important spending (like rent and utilities) is kept as low as possible. It’s certainly helped me in reaching my financial goals. Being young and single, my living demands are less (I don’t have a family that need housing!) and I can save a higher proportion of my income because I’m not spending a huge proportion on rent.

It’s not feasible for everyone but if you can, saving money on this now will be well worth it in the long run and give you more flexibility with your spending in the present.

Not Urgent + Not Important

Spending in this category can be the most fun but it can also be the worst for your financial health. It’s also the area most people can improve in if they want to make a positive change in their spending habits.

Perhaps you go shopping every weekend just for fun, or you are always browsing and buying stuff online. If you want to get in better financial shape many people have found success with a ‘spending diet’ or by setting themselves the challenge of completing ‘no spend days’.

Spending money on things that aren’t important or urgent has the potential to derail the financial future of even the highest earners. Ultimately you need to be ever vigilant to marketing and if you do get tempted to buy something you don’t technically need I can recommend undertaking a 30 day challenge to ensure you’re not left feeling full of regret or with an empty back account.

Not Urgent + Important

This is the area I’m most excited about.

It’s why I started Magical Penny –to encourage and show people how to start doing something that’s not urgent but is incredibly important because of the power of compound interest. Saving for the long term.

Retirement planning doesn’t start to feel urgent in the minds of most people until they start entering their 40s and 50s but by then, the magic of compound interest does not have much time before retirement to transform a modest sum into a sizable nest-egg. Starting to save in your 20s and 30s is therefore one of the most important things you can do to grow your pennies into meaningful sums that can help you live the life of your dreams.

The sad thing is that it’s all too easy to not save for retirement because there are so many things that need to be paid for before you get there: Perhaps you’re waiting for something else before you start:

- Until after a house payment

- Until after a wedding

- Until all debt, including personal loans has been paid off

- Until you’re earning more

The problem is there will always be something else and the longer you leave it the more daunting it becomes. If you do nothing else it’s worth at least learning about investing, even if that means you have to read about pensions whilst you are still fresh-faced and just out of university! It will be worth it though. And Magical Penny will be hear for every step of the way so don’t miss a post.

To Sum Up

If you want improve at anything you have to prioritise it in your daily life, otherwise it gets forgotten, or the day never actually comes along. It’s the same with money, so get yourself in a good financial shape today.

Make it a priority to be awesome with money, even when life gets busy.

Because it always is.

Enjoyed the article? Click and read the most popular Magical Penny posts this month:

- Four Things to Consider when Buying Unit Trusts or Mutual Funds – 295 Views

- Variable Rate or Fixed Rate Home Loans? The Case for A Variable Rate – 161 Views

- Final Salary Pensions – 159 Views

- Attending University without Student Loans -A Debt Free U Review – 139 Views

- Magical Penny -Grow Your Money. A UK based Personal Finance blog written by Adam Piplica – 136 Views

You must log in to post a comment.

{ 3 trackbacks }