How many different pension pots have you got?

How many different pension pots have you got?

Do you know how much is in each of them?

And are you saving enough for the kind of retirement you want?

If you have ever worked for an employer, it’s likely you have a pension fund of some kind. In the UK it is now the law for an employer to provide a workplace pension as part of ‘auto-enrolment’. But it’s been a long time since the days when a worker was likely to stay with their employer for their whole career and receive a gold watch and a generous pension to keep them fed and warm in their retirement years.

The younger generation are much more likely to job-hop as the rate of change in the world accelerates and new opportunities are searched out.

In many ways this is a positive thing but it can lead to people finding they have lots of tiny pension policies, one from every employer they’ve ever had, so it’s no surprise that many of us haven’t been able to keep track of our pension plans over the years, and this could be a very costly mistake.

Looking through the details

I work in financial planning and spend a considerable amount of my working life digging through pension policy statements and valuations, making sense of what pensions and investments our clients have, and whether or not it’s worth consolidating the pensions into a single arrangement. I’ve seen first-hand what a mess a lot of people’s pensions are in, and not everyone can either afford a financial planner, or needs a financial planner to sort out their pensions.

Thankfully there’s now an easy solution, but first let me share my own my own pension consolidation experience.

How I brought my pensions together

I didn’t even have to move employers to end up with two pensions. After university I got a job and began making regular pension contributions. After about two years the company changed the pension provider they used and asked us all to sign new paperwork. I agreed to the change but in my naivety I assumed the pension scheme I had been paying into for the past two years would be transferred to the new pension scheme. But this did not happen. My new contributions along with those from my employer went into the new scheme from that point onwards, but my old scheme was left in place. I continued to receive yearly statements through the post, but no more money was going into that first pension. Half a year later I moved companies and another pension scheme  was opened for me.

was opened for me.

If you’re keeping count, that’s three pensions already, each with only a few thousand pounds in. You can imagine how this could get increasingly complicated over a few decades of work.

After I made my career change into financial planning and became experienced with pensions and investments I decided to take what I had learned in my day job and switch my own pensions into one scheme. Not only would I single-handedly save a tree or two in the rainforest by reducing the amount of paperwork coming through my letterbox about my pensions, but it would be easier to keep track of the value and assess the investment mix.

The process wasn’t particularly difficult in my case, especially as my pensions were simple ‘defined contribution’ pension schemes with no guaranteed benefits, but even as someone who does this type of analysis in my day job, it was still a bit of a hassle getting it all worked out. That’s why many clients in my financial planning day-job pay me to do pension reviews. But you don’t always need a financial planner to consolidate your pensions into one place for better clarity and easier administration.

Enter Pension Bee

Enter Pension Bee

Pension Bee provides an easy way to consolidate your existing pensions into one easy to manage pot. You provide your pension information and PensionBee sorts out the transfers bringing all your pension pots together under one roof with the same consistent charges and investment choices. You can then keep up to date with the value of your pension and add to it when you’re able to.

What to do before you consolidate your pensions:

What to do before you consolidate your pensions:

Before you consider consolidating your pensions it’s important to check if there are any valuable benefits attached to your plan. Phone up the pension companies and ask them what type of pension you have. Ask them if it is a standard ‘Defined Contribution’ pension – if so then great as they are the simplest and most worthwhile to switch. It’s likely you won’t be able to switch the work place pension you’re currently paying into but as soon as you leave your job and the pension becomes ‘paid-up’ you can move that pension at that time.

Whilst you are on the phone with your pension provider, ask them for a summary of the charges. (If your total charges are over 2%, then that’s expensive. Also ask if there are any guaranteed benefits attached to your pension. Examples of benefits are “guaranteed annuity rates”, and “guaranteed minimum pension”. You also should ask for both the current value and the transfer value. If the two figures are different there might be a penalty for moving your pension, in which case it would be wise to speak with a financial adviser. Similarly, if you have a “with profits” policy you also need to understand if you are eligible for any bonuses that may be lost if you transfer away.

Once you have the information about your pension and you’re satisfied your pension does not have any valuable guarantees, it is likely to be appropriate to consolidate into one easy to manage plan, such as the one provided by PensionBee.

PensionBee does all the hard work of consolidating your pensions

They also tell you about any guarantees they find (but I still think you should do this yourself too with a quick phonecall).

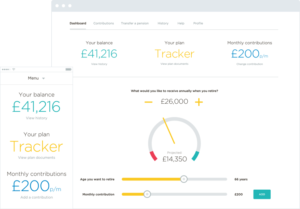

PensionBee also allow you to easily view the value of your new pension using their online dashboard – this is actually impressive and lots of pension providers don’t have online functionality even in this day and age! PensionBee also allows you to easily add to your pension and watch it grow.

What does it cost?

What does it cost?

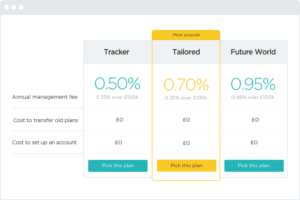

The charges are reasonable:

- The ‘Tracker’ plan is 0.5%,

- Tailored is ‘0.70%’

- ‘Future World’, an ethical focused plan is 0.95%

And customers with pensions larger than £100,000 will pay half the fee on the portion of their savings above this amount (0.25% for Tracker, 0.35% for Tailored, and 0.48% on Future World)

For example, and in contrast to competitors, PensionBee only charges one annual fee, so a customer with a £250,000 pot could only pay 0.35% per year.

Most of the pensions I come across in my day job are more expensive than this.

I admit there are slightly cheaper options around if you want to spend more time managing your pension yourself, but if you’re not inclined that way, PensionBee is an excellent way to get re-engaged with your pensions and simplify your arrangements. This is beneficial because it will allow you to know how prepared you are for retirement and if you’re not on track you can make the necessary steps to improve your financial life.

To this end their handy pension calculator can also help you discover how much you should be saving.

One thing to remember: PensionBee does not provide financial advice so using the service means taking things into your own hands. If you transfer a pension with a valuable benefit and then believe it was a bad idea, you can’t complain to anyone, as you would be able to if you had received regulated financial advice.

I’m happy to share my thoughts about PensionBee because it fits a gap in the market.

I’m happy to share my thoughts about PensionBee because it fits a gap in the market.

For those with big pensions and who can afford financial advice, financial advisers can add a lot of value, but for those with only a few more modest pensions, paying for advice is not always worth it.

For those who want to be really hands-on with their pensions and do their own management, there are cheaper options than PensionBee but it means lots of research and phone-calls, and that can be intimidating or just plain boring for people who don’t have the desire or experience to navigate the world of pensions and investments.

So if you have a few lower value pensions and want to simplify your life then a service like PensionBee is brilliant at cutting out the hassle-factor and helping you get engaged with your pensions in an easy and transparent way.

This post has been written in collaboration with PensionBee who are authorised and regulated by the Financial Conduct Authority. With pensions, your capital is at risk. The value of your pension with PensionBee can go down as well as up and you may get back less than you started with.

You must log in to post a comment.