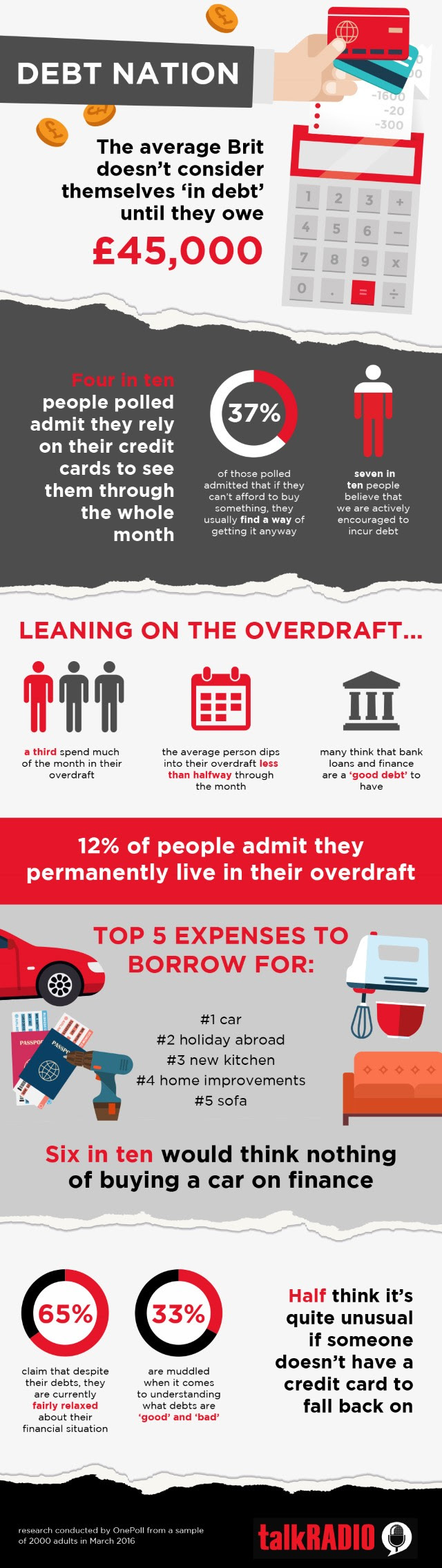

The average Brit doesn’t consider themselves ‘in debt’ until they owe £45,000, according to concerning new research.

This recent study into the financial behaviour of 2,000 adults, from this month (March 2016) by new speech radio station talkRADIO, shows the majority have a worrying lackadaisical approach to borrowing and owing money.

Four in 10 people polled admit they rely on their credit cards to see them through the whole month, and usually have a balance of at least £3,000 debt to pay, while a further third spend much of the month in their overdraft.

But it is only when the mountain of debt reaches above £45,000 that people start to panic, and realise that they need to take action to remedy their financial situation.

The research highlights that the days are long gone when an overdraft was for emergency borrowing only and a credit card was something we pulled out when there was no other option. Certainly increasing numbers are blogging about their journey out of debt, which can creep up through even perceived ‘normal’ spending.

Another research finding was the average person dips into their overdraft less than halfway through the month, with twelve per cent of respondents admitting they permanently live in their overdraft.

Source

Good and Bad Debt

When it comes to understanding what debts are ‘good’ and ‘bad’, a third of adults admit they are muddled. Council tax debt, tax debt and utilities companies chasing for payment are considered the very worst kind of debt to be in. But mortgages, student loans, finance options and bank loans are largely considered ‘good debts’ by many.

But debt, regardless of what type it is, can stop you from achieving your financial goals. Even ‘good’ debt, should be eliminated.

For more articles on Debt, read the Magical Penny Debt archive.

You must log in to post a comment.