I remember watching the local TV news when I was very young.

I remember watching the local TV news when I was very young.

The story was about excited people waiting around at a new car dealer in the middle of the night. They were there to purchase a brand new car. But why couldn’t they wait until the morning?

The cameramen were shining bright lights in their faces as the new car owners started the engines of their shiny new cars. The drivers then started honking the car horns before excitedly driving away, out into the night.

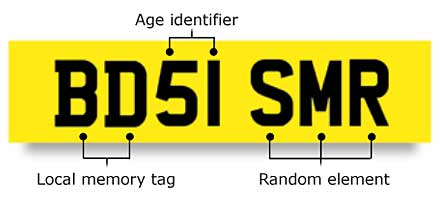

The excitement and media attention around these new car purchases was because, at the stroke of midnight, new vehicle registration numbers were released, and for a few precious hours, days, and months, the drivers knew they were one of only a select few driving a new car, the proof of which was clearly shown by the number-plate letter that began with the letter M.

The excitement and media attention around these new car purchases was because, at the stroke of midnight, new vehicle registration numbers were released, and for a few precious hours, days, and months, the drivers knew they were one of only a select few driving a new car, the proof of which was clearly shown by the number-plate letter that began with the letter M.

New Car Fever

Buying a car with the latest number-plate, the status symbol of choice for thousands of new car buyers often led to record sales figures for one month each year.

To even out the sales a bit, vehicle number plate changes were made bi-annual in 1999, but even to this day there’s a surge of buyers when the number plates change. Earlier this year, in March 2016, when the latest registration plates were released, sales of new cars spiked by 5.3%, the biggest increase since the bi-annual plate change began in 1999, according to the Society of Motor Manufacturers and Traders (SMMT).

A majority of new cars are purchased with a finance deal. This is an expensive way to buy a car, but new car buyers could be paying an additional £520 for their new car by not shopping around for finance according to new research.

This added cost works out to be about 500 litres of petrol that would last about six months for most people.

This added cost works out to be about 500 litres of petrol that would last about six months for most people.

Research from Swedish savings and loans provider Ikano Bank reveals that motorists are losing out by not shopping around for the best deal before choosing how to finance their new car:

- Just over a fifth (22%) chose the cheapest finance option available

- More than a quarter (27%) choose the easiest option instead

- A third (32%) research how to pay for a new car in less than 15 minutes

- This compares to a third (31%) who spent between a week and a month researching which car to buy and a fifth (19%) who spent between one and six months

- Younger people are much more likely to spend more time researching how to finance their new car, with 83% of those aged 18-34 spending more than 15 minutes, compared to 52% of those aged over 65

This means motorists are adding on average £520 to the cost of their car, by not shopping around for the best finance deal.

People often opt to take finance directly from their car dealer and don’t realise that very often, this isn’t the best option available. Securing finance for a car can be completely separate from the purchase of the car itself.

Ikano Bank’s own internal data shows that customers take out a loan to buy a car more than any other purpose and the products offered by the bank provide a headline rate of 3.2% APR Representative (on loans from £7,500 – £15,000).

Research methodology

The results of the nationally representative survey were extrapolated relative to the UK population aged 18 or over. In March 2016 PCP research conducted an online survey among a nationally representative panel of 906 British adults who had bought a new or used car in the last three years. Fun Fact: I used to work for PCP Research a few years ago!

If you’re serious about growing your magical pennies you would NOT buy a new car, and especially not with a finance deal, but if you are determined to buy a new car on finance, do make sure you get the best deal by spending some time researching your options.

You must log in to post a comment.