Previously on Magical Penny: Paying off UK Student Loans

When I started university in 2004 I took out student loans to pay for the three years of student life. There didn’t seem to be any other alternative. Where was I going to get the £3000+ a year (Now it’s £9000+) to pay for tuition alone!

No one else, including teachers, parents and friends had any answers.

Until now.

In the end I thought I was well prepared: I was awarded a choral scholarship, worked during term-time and during the holidays (12 hour days in fact) but I still needed to take out student loans to get me through.

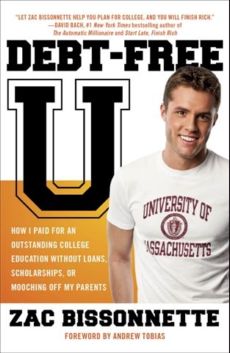

Yet there are other options for getting through college –as Zac Bissonnette’s new book has set out to explain:

Yet there are other options for getting through college –as Zac Bissonnette’s new book has set out to explain:

Debt-Free U –How I paid for an outstanding college education without loans, scholarships, or mooching off my parents.

Writing from an American perspective (where the cost of ‘college’ can be significantly higher than most British universities), Bissonnette’s book takes on the myths of needing student loans and questions the value of attending supposed ‘elite’ colleges with tuition costs of hundreds of thousands.

Thinking about where you will get the money

In the UK, student tuition is a relatively new concept and university used to be free for the select few who were admitted. For example my father went to university through a grant that paid for his tuition and accommodation.

With this in mind, I don’t think my parents nor I ever thought about where the money for university was going to come from. But times have changed and costs are increasing every year. We have to take out student loans then right?

Bissonnette tackles this idea straight on, encouraging both parents and would-be students to begin saving for university early and often. Easier said than done of course but Xak has a few ideas and it’s much easier the earlier to you start.

Regardless of the politics behind rising tuition costs, he concludes all parents should consider saving for their children’s higher education from birth (or at least a few years before high school graduation!), if they are to avoid their children requiring debt to fund a university degree.

Student Loans Are a Burden

Debt Free U references the burden of student loans throughout the book.

This is one of the most important points in the book because it’s all too easy to forget you will need to pay the money back some day.

And no matter how much you hope to earn in the future, the monthly payments may be larger than you estimate once interest begins to accrue. Add to this the growing disconnect between graduate debt and graduate job wages, student loans can leave university graduates in a precarious financial position for many years after graduation.

From a British perspective, this chapter serves as a warning but it is comforting to know that British student loans, taken out from the Student Loans company, are much less of a burden than most American student loans, and are even lower than America Federal students loans (which typically have the lowest interest rates in the US).

British Student Loan positives:

- The interest rate is roughly matched to inflation (set once a year)

- Repayments come out of pre-tax earnings

- Repayments start and stop with your income so if you lose your job your repayments are paused

For more on British Student Loans: Paying off UK Student Loans

Regardless of the terms or whether you’re in the UK or the US, it can’t be emphasised enough –student loans are not charity –you have to pay them back, something that’s all too easy to forget, particularly when you’re taking them out and have little concept of the actual amount of time it will take to pay them back.

Choosing a College

Bissonnette argues that ‘great colleges’ are over-rated. Citing several studies, he reminds us that colleges are made up of individual students and the only reason why graduates of top colleges do well is because the top performers were motivated to go to that college in the first place.

In other words, and to use a British example, as long as you’re good enough to get into Oxford, you’re likely to do as well as someone who actually went to Oxford.

In the UK where going to Oxford and going to another college actually costs the same amount, this argument is a moot point, but when considering American colleges where the price-tag for attendance is so dramatically different, it doesn’t make sense to go to somewhere that requires you to take out a huge loan.

The take-home point is that you determine you success not your university and taking out huge student loans to go to a prestigious school could harm you more than help you as the burden of student loans narrows your life choices after graduation.

Further reading on reducing college debt at Bargain Life

Cutting the Costs and Increasing Value

Other tips in the book for cutting the cost and increasing the value of your university years include:

- Attend a State University (which typically have the lowest tuition fees) but network and build your skill set as much as you can –the name on the degree is less important than your skills, experiences and contacts.

- Take advantage of all the opportunities to try new things: sports, groups and clubs, to gain experience and skills you can use later on in life. The big state schools that Bissonnette recommends have these opportunities in abundance due to their sheer size –I found myself nodding to this myself as I turned down a ‘prestigious’ but smaller university for a larger one that allowed me to follow my love of choral singing and making music.

Make Money and Prepare for a career

As much it would be great if parents started saving earlier and could fund a university education for their children, there is a great deal of value in the student getting a job to help pay for expenses.

Bissonnette expands on this idea for several pages concluding that university should be about having a great time, learning lots and building skills for the workplace. Amen!

For me, getting a job was a necessity to pay for living expenses and in the holidays I worked for the company I ended up joining after graduation (and I’m still there today!). Getting your first job can be really intimidating (I remember!) but the benefits are huge, especially if you channel the money into reducing your student loan bill rather than spending it as soon as you get it.

Conclusions

The most powerful thing about this book is that it has a surprisingly rare message – student loans aren’t the only answer to the university funding question.

With costs set to rise further it’s more important than ever to start saving earlier, focus on your skills rather than just paying for a prestigious school, and to make use of your time by entering the workforce before graduation.

At the risk of sounding like my parents when I was 16, it’s for your own good!

Despite its American focus, it’s an interesting read for anyone preparing to go to university or to send their children there – and you can support Magical Penny by buying it at Amazon by clicking the link below.

Buy the Book and Get Prepared for University Today

Debt-Free U: How I Paid for an Outstanding College Education Without Loans, Scholarships, or Mooching Off My Parents

{ 3 comments… read them below or add one }

Great post!

Thanks Rob 🙂

Student loans have a certain level of flexibility with them, especially when it comes to cosigners. While a credit check is required for private student loans, your parent or guardian can cosign with you.

You must log in to post a comment.

{ 3 trackbacks }