Whether your ideal retirement would be sunning beside a beach or spending time with the family, getting your retirement fund in order early on is your best chance at making it happen. Obviously, employer-led retirement plans are now a significant step in that direction, but retirement ages that are only on the up suggest that more needs to be done to ensure comfort in later life.

While the definition of comfort varies for everyone, most of us would at least prefer to eliminate money worries, as well as knowing that we’ll have plenty left for our loved ones no matter what. Unfortunately, standard pension plans that barely broach the $10,000 mark struggle to make that happen, even with the addition of state pension contributions.

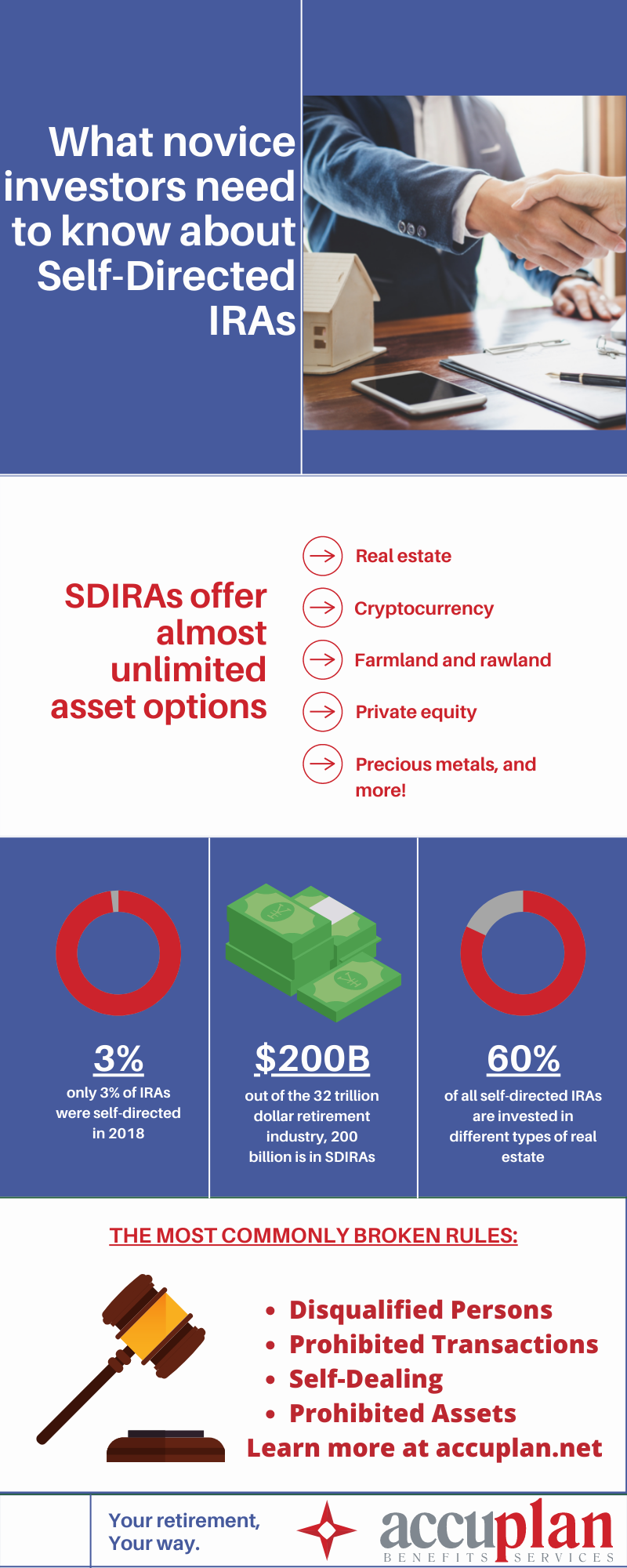

This is a harsh reality, and it’s one that self-directed individual retirement accounts (SDIRAs) aim to help overcome with a focus on investments complete with tax advantage across a range of options, the most common of which is real estate. Further investments including private equity, cryptocurrencies, and hedge funds can also ensure retirements that keep on giving.

Unfortunately, with so many available investment options, and with sometimes stringent rules surrounding prohibited purchases, disqualified parties, and more, getting started with the benefits of SIDRAs can be so daunting that you may never even get far enough to feel those plus points. Luckily, there are surprisingly simple ways to work past even these setbacks to finally enjoy your idea of a ‘comfortable’ retirement, and the infographic below provides a great place to get started!

Infographic Design by: https://www.accuplan.net/

You must log in to post a comment.