If you’ve been following any of the Magical Penny’s advice you should hopefully have managed to save some of your pennies in recent weeks. If not, don’t worry: review your spending plan (you have one right?) and begin one simple step:

Are your pennies really growing?

Are your pennies really growing?

How do you know if you’re moving in the right direction with your finances? You could be moving money into savings accounts occasionally but does it stay there or does it get spent? Do you find yourself moving money around rather than leaving it alone?

When I started automating my savings, setting up a standing order to send money regularly into a savings account, I thought I was doing well.

And in many ways I was: automation takes the will-power out of saving.

However automation doesn’t stop you from raiding your savings when something expensive comes along!

Spending part of your short-term savings is fine -it’s what an instant access account is for-but it can be all too easy to spend any other savings you have. There is a way however to alert you if this begins to happen:

You need to track your net worth

Your ‘net worth’ is a personal finance term for the sum of your assets (things with a positive value like your savings) minus any liabilities (things with a negative value like credit card debt or a loan). Calculating your net worth is a really useful way of understanding your total financial situation.

Whilst there is much debate on what to include and what not to include in your ‘net worth’, the actual number isn’t that important (at least at this stage for those of us in our 20s and 30s). The important thing is how the number changes over time as it gives you an idea of of whether you’re moving in the right direction with your growing pennies.

Consistency

Don’t underestimate the power of keeping a regular log of your net worth. Don’t worry about what to include or what not to include at this stage. Just make your list to include what seems right for you: perhaps your net-worth would include simply the total of the balances of your current account and a savings account and then taking that away from your credit card balance. Whatever you choose make sure you keep it consistent over time.

You need to make sure you do the calculation at the same time each month as any income payments and out-going bills can drastically change your net-worth in the short-term. Personally I do it on the last day of each month: I add up the total of all my accounts and I’m left with a number. If you had debt you would take your debt away from this number to calculate your number.

Note: personally I don’t include my student loan debt (my only debt) in this calculation: not because I am in denial about the debt, but because the balance is only updated by the Student Loans Company once a year rather than each month when I pay it off so the balance would not accurately reflect my true debt level.

If you find the idea of checking all your accounts every month a bit overwhelming then you can do it quarterly or half-yearly. However, if you wait too long between checking your net-worth you may find that you have not made any progress in several months and were not aware you needed to change your spending and saving habits to reach your goals.

Ignore the noise

Financial ‘noise’ is all the volatile fluctuation of values and figures in your bank accounts and investment valuations. If you are self-employed your net worth number is likely to be very inconsistent day to day but even those with a monthly salary will have a fluctuating net worth as income enters your bank accounts and money goes out when bills are paid.

Financial ‘noise’ is all the volatile fluctuation of values and figures in your bank accounts and investment valuations. If you are self-employed your net worth number is likely to be very inconsistent day to day but even those with a monthly salary will have a fluctuating net worth as income enters your bank accounts and money goes out when bills are paid.

Your account balances can fluctuate even more if you hold investments as the price of your stocks and shares go up and down almost constantly when the markets are open. These fluctuations however are not meaningful (unless you are selling at the immediate moment) so should be ignored on a day-to day basis. Once a month is fine to view your net worth number to determine the trend to see if you’re on-track to meet your savings goals.

Be Honest

- “Whatever happens to your number month to month, you need to be honest with yourself”

When you look at your net worth each month the numbers won’t lie. If you have been spending your suposed savings the number will be lower. If you have been truly saving, the number should be higher. Whatever happens to your number month to month, you need to be honest with yourself. If your number was lower this month, was there a good reason? Had you gone on holiday or perhaps simply had an expensive month with lots of birthdays for example? And if your net worth had gone up was this the result of real saving?

I may write a blog about personal finances but I’m not perfect. Doing this exercise myself each month has helped me realise that I’ve been off-track for some months recently. For example, my net worth has been going up for the past few months but some months have only been higher because of some recent investment returns. By calculating what my net worth number would be if my investments hadn’t gone up I could see that I had not saved my target figure in real terms. This gave me the perspective I needed to ensure I fixed this in the following months.

The great thing about this journey is that each month we have a chance to start afresh: to decide which direction we will take with our net worth. Willpower however works best when accompanied by short, medium and long-term goals. These can be invaluable at keeping up motivation and forcing us to be honest about our financial priorities.

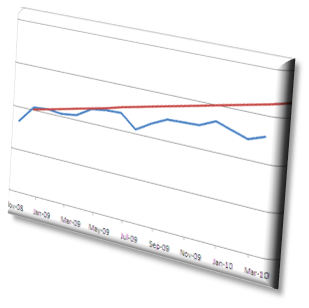

A genuine chart of my 'net worth' (and a stretch target) over the last year

Net worth is not Self-worth

Finally it’s important to remember: your net worth does not define you.

Whilst growing your pennies is a worthy goal that will give you flexibility and freedom in the years to come, it’s important that you do not define yourself by how much money you have at any given time. It can be fun watching your magical pennies grow but remember a high ‘net worth’ is not an end in itself.

If you’re not writing down your net worth every month you will find it difficult to know if you are making consistant financial process. Once you do then it’s a simple as being consistant and checking if your net worth is moving in the right direction. Be honest with yourself about your spending and you will, in time, catch the thermals of wealth.

In other news

The Magical Penny Facebook page now has a new ‘Welcome’ tab so be sure to join the fun @Facebook

{ 5 comments… read them below or add one }

I like this article.

When I was a temp, being paid on each friday I kept and still keep a financial spreadsheet every Friday. I started tracking my networth in a standard fashion about two years ago, but have financials going right back to 2006…

Brilliant idea. Might help me pay off the cheeky 400 of festival ticket debt I have acquired since last month that bit quicker! Could be something useful to do with the day off. Also, you’re learning to avoid comment rants by including the self-worth bit; nicely balanced post.

Indeed, great post Adam.

As I was discussing with you, I use my 3 bank accounts to measure my Net Worth, and have done since I left university. My main method is looking at my main incoming/outgoing account, as this tells me what I’ve spent each month in comparison to what I’ve earned (and saved).

I’ve been paying particular attention to this account since the money in my savings accounts will all soon go on the deposit for my house, meaning it’s not a true reflection of my ‘worth’ (it’s pre-allocated spending money, rather than actual ‘savings’).

But it is a great tool, and I’ve been able to cut my spending drastically over the last few months using it as a guide.

Keep them coming Adam!

Perhaps place to add a resource to your website? Can you put up downloadable excel files for people with basic networth fields to allow people to track on their own?

If so i’d happily help if you’d like to amalgamate my networth spreadsheet with yours…

@Jon and The Other Adam -thanks guys. It really is amazing actually writing it down makes a difference.

Rightly Knightly: good suggestion. I’ve thought about it already (and there’s certainly a wealth of different spreasheets available online). I didn’t implement it straight away because i feel there’s a certain power in creating something yourself – Something that works for you.

But there is a place for downloadables so watch this space.

You must log in to post a comment.

{ 1 trackback }