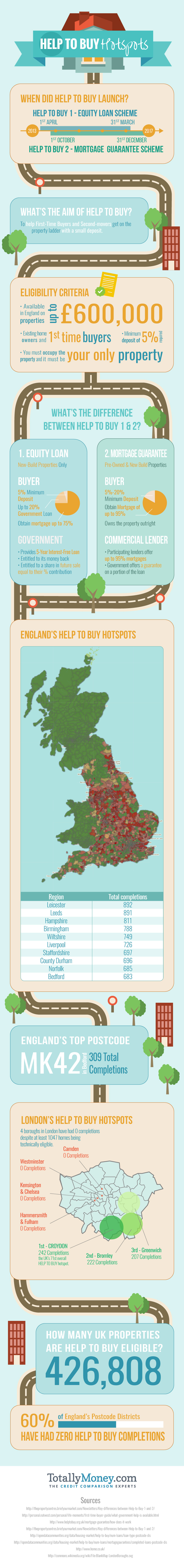

It’s been over two years since the ‘Help To Buy’ initiative was launched in the UK in April 2013, but 60% of England’s postcodes have no ‘Help To Buy’ Homes.

There are more than 400,000 eligible homes that buyers could have made their own through the scheme but according to housing market data from the HM Treasury, 1,261 out of 2,117 Postcode Districts in England have yet to see any ‘Help to Buy’ mortgage completions.

See also the interactive map from TotallyMoney.com,

The map in the infographic above highlights all mortgage completions across the UK that were as a result of either the Help to Buy 1 (Equity Loan) or Help to Buy 2 (Mortgage Guarantee) scheme, revealing 1,261 ‘black spots’, where no Help to Buy properties are available or where the scheme simply hasn’t been taken up.

Other findings of note:

- Mortgages on 52,691 Homes in England (as of February 28th, 2015) have completed as a result of Help to Buy so far.

- 42% of postcode districts in England e.g. NW1 (1261 out of 2117 Total) have yet to see any ‘Help to Buy’ mortgage completions.

- Leicester is England’s number one Help to Buy city, with 892 completions.

- MK42, in Bedford, is England’s top Help to Buy postcode, with 309 completions,

| Top 10 Regions | Total Completions |

| Leicester | 892 |

| Leeds | 891 |

| Hampshire | 811 |

| Birmingham | 788 |

| Wiltshire | 749 |

| Liverpool | 726 |

| Staffordshire | 697 |

| County Durham | 696 |

| Norfolk | 685 |

| Bedford | 683 |

The Help to Buy initiative is available in 2 parts: An Equity loan and mortgage guarantee options:

Help to Buy 1 – Equity Loans

The initial scheme offers first-time buyers easier access to new builds. Help to Buy 1 offers 5-year interest-free Government loans up to 20% of the property value. Once the 5-year interest-free period is complete, interest is charged at 1.75%, with annual rises of 1% above inflation. First-time buyers using the scheme require a minimum 5% deposit and a mortgage to cover the remaining 65-75% of the property value

Help to Buy 2 – Mortgage Guarantees

The second phase of the scheme offers mortgage providers more incentive to lend higher loan-to-value mortgages. Access to Government guarantees on these loans allows lenders to give both first-time buyers and existing home owners mortgages with deposits as low as 5% on new builds and older properties.

I have friends in Leeds and Leicester who have taken advantage of the scheme, but from the looks of the data, my perception about take-up is more rosy than it should be as Leeds and Leicester are the areas with the highest take-up rate. I would attribute this to quantity of affordable housing stock but its certainly interesting to see how the take-up in distributed up and down the country.

Do you have a ‘Help to Buy’ story you can share in the comments or would like featured on Magical Penny? If so, please get in touch (adam AT magicalpenny.com)

You must log in to post a comment.