Internet banks are an alternative to brick-and-mortar banks. These banks don’t have physical branches that you can visit and operate purely online. There are various pros and cons to using these banks. This post weighs up these pros and cons.

Internet banks are an alternative to brick-and-mortar banks. These banks don’t have physical branches that you can visit and operate purely online. There are various pros and cons to using these banks. This post weighs up these pros and cons.

Better interest rates

Because internet banks do not have such high running costs, they are often able to offer better interest rates than traditional brick-and-mortar banks. This makes them a popular place for people to put their savings. This isn’t to say that you’ll always get better interest rates at an internet bank – it’s still always worth shopping around for the best interest rates when choosing somewhere to invest your savings.

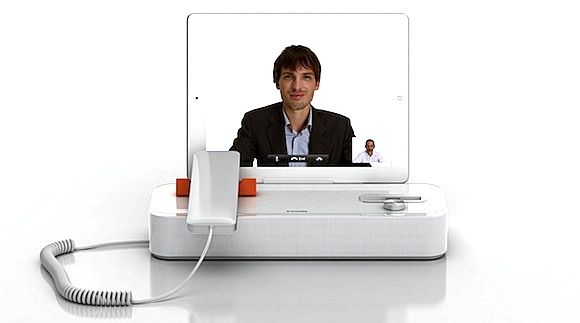

Strong online support

Internet banks are often ahead of the curve when it comes to introducing new online banking technologies. These banks were some of the first to introduce options such as cashing-in cheques online. Many of these banks also have very good online customer support compared to brick-and-mortar banks. This includes online chat features for discussing any concerns that you may have.

No in-person support

No in-person support

Some people prefer to talk to a bank representative in person. This is particularly the case for those who aren’t very internet-savvy. With an online bank, you can’t just walk into a branch when you need help with an issue. Of course, this may not be too much of a concern for some people – if you live somewhere fairly remote, you may already find it easier to talk to bank representatives on the phone or online, in which case using an internet bank isn’t going to be any different. Just bear in mind that there may be extra fees and security concerns for services such as depositing cash, as you’ll have to mail this instead of taking it into a bank.

Choice to invest in crypto

Cryptocurrencies have become very popular in recent years. These digital currencies can be a great investment asset, as well as providing a decentralised currency that you can use for foreign transactions without having to pay exchange fees. A crypto bank is an online bank that allows you to store and carry out transactions with cryptocurrency. There may even be options like crypto savings accounts and crypto loans. Even if you have no interest in investing in crypto, you have the option when you opt for an online bank.

Not as well-established

Brick-and-mortar banks are typically well-established, making them more reliable and trusted. With internet banks, you need to be more careful as to which ones you choose. Some smaller and newer internet banks may run into teething issues, which could result in a poorer service. Read reviews of internet banks before signing up so that you can get a good idea of public perception. Such banks still need to meet certain regulations when it comes to security, so you shouldn’t have to worry too much about this.

You must log in to post a comment.