Welcome to Part 3 of a series of posts about investing in property with The House Crowd. Part 1 provides some background to the innovative concept of crowdfunding investment property, and Part 2 outlines the registration process. Now, in Part 3, I’m exploring the exciting bit – shopping for the right investment!

Once you are registered with The House Crowd you can begin looking at information on the properties and development opportunities that are looking for investor funds. Your portfolio summary page will be empty until you have selected an investment.

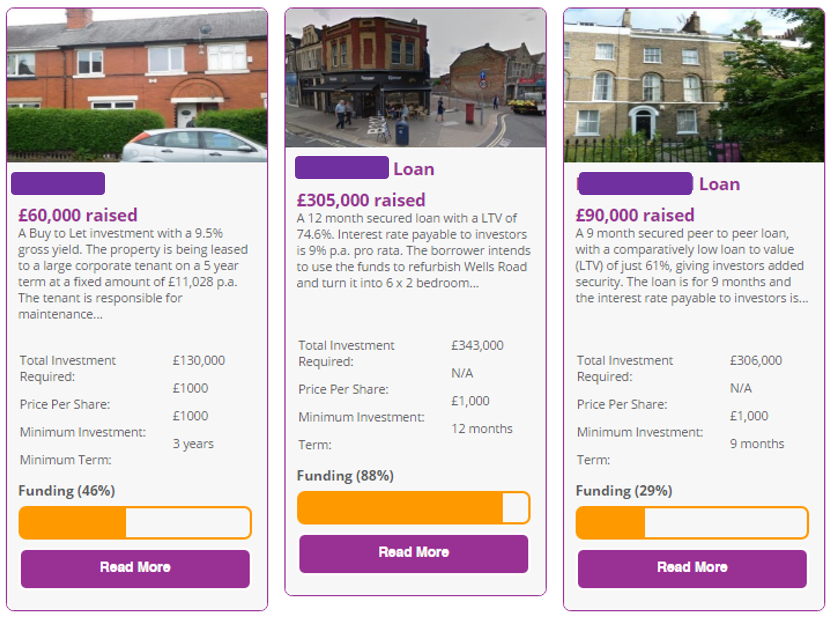

The site is regularly updated with the latest investments that are available. Here’s a recent screenshot (hidden some details as these are live investments and I’m not providing investment advice, only showing you for educational purposes).

For each investment you can see the total amount of investment required, the term and how much the yield will be on per share. The minimum investment for most deals is £1000.

As someone who is used to shopping for mutual funds and index trackers in the equity markets, the research process was really interesting as I could actually see what I could be investing in. The investments on The House Crowd are real properties in the UK that require investor funds and have all gone through a high level of due diligence before they are added to the site.

When looking to select which investment you should note the investment term particularly as this will determine when you can realise any gain which can then be used or reinvested in another project.

To gain experience of using The House Crowd platform, I invested in a Bridging project to fund a brand new development of luxury apartments in Cheshire. The first phase of the project is now fully funded, with the £600,000 second phase set to launch in August this year ahead of a planned June 2017 completion date.

I’m sharing the details to help you gain an understanding of the process.

The development requires a total of £1 million over 3 phases to develop the site. Investors are funding this development and can expect a return of 10% per year. There is a risk of loss as with all investments, but all investors are protected by a registered legal charge using the same structure banks often use to protect their development loans.

In the phase I invested in the target was £530,000 over a term of 12 to 17 months.

In the phase I invested in the target was £530,000 over a term of 12 to 17 months.

The artist impression pictures look impressive, but a true investor should be more interested in the Investment pack that is provided for each project.

This investment is a bridging loan so includes a Lender Fact Sheet which summarises the material terms together with the Lender Terms and Conditions which you must read before investing.

This investment is a bridging loan so includes a Lender Fact Sheet which summarises the material terms together with the Lender Terms and Conditions which you must read before investing.

If you decided to invest in such a project you would then fill in the application form and once approved, send the funds you are investing to the solicitor who is handling the process. The form of acceptance can be completed both online and by post.

If you are investing in your first project with The House Crowd you will also need to send photo ID to comply with Anti Money Laundering legislation, along with a Source Of Funds form.

If you are an overseas investor you will also need to provide 2 clarifications of address but unfortunately residents of the USA are excluded from investing.

With all the paperwork filled in and sent off, the investment is live and I became a property investor of sorts!

I’m excited to see how the build progresses and will be sharing updates in due course.

My friend, David has already invested in a number of projects with The House Crowd and I’ll be sharing his thoughts about the experience in another post.

Update: Read his story here.

Happy Investing!

You must log in to post a comment.