For many, paying off a mortgage is a huge financial goal that takes much of our working lives to achieve.

For many, paying off a mortgage is a huge financial goal that takes much of our working lives to achieve.

Whilst some may prefer to pay off their mortgage as quickly as possible, others keep their mortgage for the full term, believing their money is better invested elsewhere for a higher return or they simply need all of their income to afford necessary every-day expenses.

Whatever your approach or financial situation, most would agree that reaching retirement without a mortgage payment is preferable. However, life doesn’t always go to plan and older borrowers who still need a mortgage have found it becoming increasingly difficult to find a suitable mortgage.

This can be attributed to the Mortgage Market Review in 2014 which resulted in many banks and building societies restricting their offerings if the borrower turned 65 before the end of the term.

Why Would You Need a Mortgage In Later Life?

Whilst living mortgage-free provides significant freedom and increased cash-flow, there are many reasons why a mortgage may still be needed in later life.

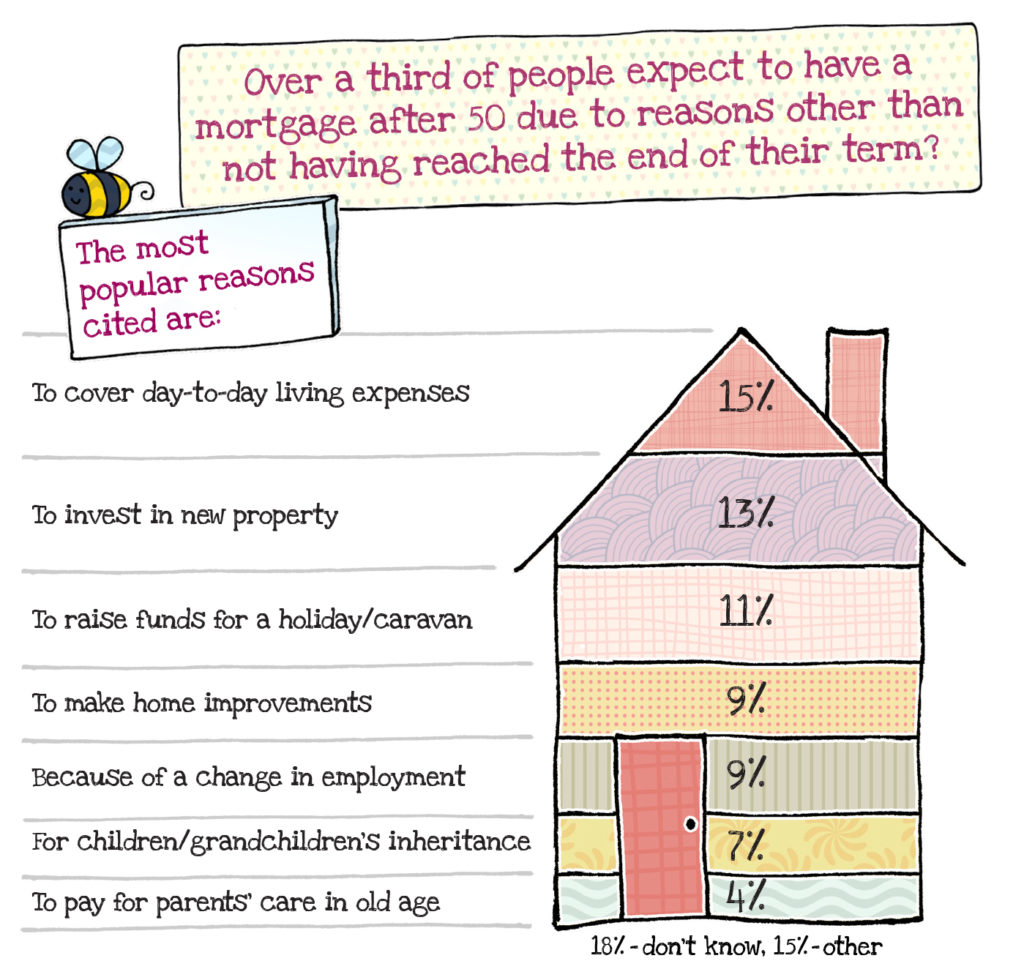

Research from Ipswich Building Society identified a number of reasons, the most common reasons being to cover day-to-day living expenses (15), the need to invest in a new property (13%), holiday (11%), or to extend or make changes to a current home (9%).

Making house improvements can be a very rational spending decision as maybe you love your house but it needs significant building work to be a comfortable place to live. Heating and energy efficiency becomes more important in later life as older people are more sensitive to the cold.

Another reality of getting older may be changes in employment status/career, the reason given by 9% of survey respondents for why they need a mortgage in later life, and there can be expenses outside of your control such as the expense of looking after parents in old age (4%).

If you do feel you need to take out a mortgage in later life (age 50 onwards), then you are not alone, with one in ten survey respondents anticipating being over 70 when they become mortgage free.

This number is likely to increase in the years ahead as younger generations are buying their first property later in life than previous generations and, due to higher house prices, mortgage terms are increasing above the traditional 25 year term.

What are the options available?

For those over 50 looking to take out a mortgage in later life there are four main options to consider:

A Traditional Mortgage

This may be the first port of call with both ‘capital & interest repayment’ and ‘interest only’ (assuming a repayment vehicle is in place) variants.

A traditional mortgage might be the simplest option but if the repayment term is longer than a traditional retirement age then some lenders might be hesitant to agree to the mortgage, or you may be forced to delay retirement.

If you do require a mortgage that extends past age 65, you should search for a provider who looks at all sources of income and assets when addressing affordability, not just earned income.

This search might lead to you seeking the second option, a later life mortgage:

Later Life Mortgage

Some mortgage providers will now take pension income into account as part of their affordability assessments though not every provider will take into account 100% of income from pensions, though Ipswich Building Society will do this.

This is useful to those wishing to take out a mortgage that will extend over the date when they stop receiving earned income, as long as there is sufficient pension assets or income to draw upon to keep up with mortgage repayments. If your total income is not sufficient to cover the full repayment of what you need to borrow, the next option might be the solution.

Retirement Interest Only (RIO) Mortgage

This is a way of extracting the capital tied up within a property and paying back only the interest on the ongoing loan. This could be useful if you have only a small income, wish to stay in your home but need to take out a mortgage to make improvements to the house or require monies for other spending priorities.

If you have sufficient income to pay the ongoing interest, this can be a good approach as you still own your home and can benefit from any appreciation.

RIO borrowers can remain in their home until a significant life event such as a move into long-term care or death of the last remaining borrower, if a joint mortgage is held.

This option should not be confused with a lifetime mortgage which is a loan that is not repaid in your lifetime, but rather the interest compounds over time and eats into the equity value of your home, finally being repaid upon death.

Equity Release

Different to a mortgage, this involves selling a proportion of your property whilst remaining to live there.

This can be helpful for those who need to release some money from their property but do not want to sell up. Whilst this might seem appealing, it is potentially very expensive, especially if house values go up as they have tended to do over time, and can significantly reduce the value of your estate.

For some this is a price they are willing to pay to stay in their own homes, but if you are considering this option, financial advice is recommended to ensure the full consequences are understood.

Making the right decision

Ultimately, if you are considering a mortgage in later life, it is now more possible to be approved for one than it has been in recent years, though you should understand the consequences of doing so, depending on the approach taken.

Many considering a mortgage in later life will already have a property but may wish to use some of the value of the home as collateral to receive the necessary cash for their needs.

Anyone requiring clarity about later life borrowing should seek the advice of an independent financial adviser who has expertise and qualifications in this market.

This post was sponsored by Ipswich Building Society

Ipswich Building Society has approximately 65,000 members and currently has over 80,000 savings accounts and over 5,000 mortgage accounts. There are nine branches across Suffolk in Aldeburgh, Saxmundham, Halesworth, Woodbridge, Ipswich Town Centre, Ravenswood Ipswich, Hadleigh, Haverhill and Sudbury. The Society also has 2 agencies in Suffolk.

80% of the Society’s members live in the East of England with the remainder living across the UK. Ipswich Building Society was established in 1849. See www.ibs.co.uk

You must log in to post a comment.