To be financially savvy, you don’t need to be an expert. Knowing yourself and your talents and weaknesses is the first step toward managing your money wisely. It’s about developing habits that will carry you when your willpower falters.

To be financially savvy, you don’t need to be an expert. Knowing yourself and your talents and weaknesses is the first step toward managing your money wisely. It’s about developing habits that will carry you when your willpower falters.

Automate everything you can

Automate your savings, your loan repayments, and your expenses. The fewer steps you have to take to get your money where it needs to go, the more likely you are to remain with it. What’s so amazing about automated savings and repayments? Once it’s set up, there should be no additional actions for you to take each month. You can set it and forget it.

Set measurable objectives

It might be difficult to stick to your savings plan, especially when you have to give up something else to make it happen. When you recall the money is going towards something you really desire, you’ll likely feel less of a twinge when you have to miss that extra drink. It’s great to have a goal, whether it’s a vacation, a house, retirement, or even a less responsible-sounding purchase like a flashy new tattoo.

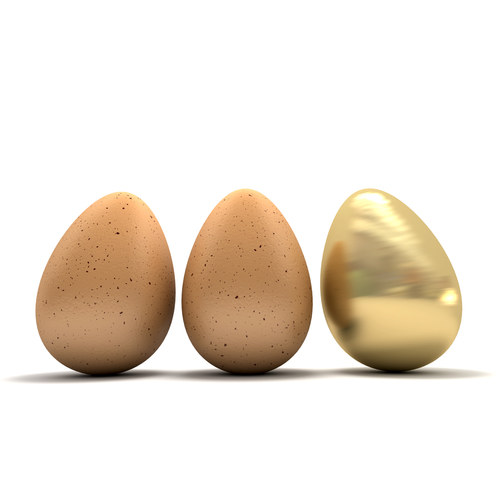

Don’t blow that unexpected gain

Don’t blow that unexpected gain

Refund of taxes? Inheritance? Birthday cash? As tempting as it may be to indulge yourself, you may be better off putting that additional money into a savings or investing account, or paying off debt. After all, you won’t miss the money if you weren’t anticipating it. And your financial goals will be appreciated!

High-interest debt should be prioritised

When you have many debts, it can be extremely frustrating to try to spread out your funds to cover all of the repayments. You may need debt help. Does this sound familiar? If this is the case, you should think about using the avalanche debt-relief strategy.

First, locate the debt with the greatest interest rate. You make the minimal payments on all of your other loans. You then devote everything else to paying off that high-interest loan. After that, repeat the process for the debt with the next highest interest rate. You’ll end up paying less interest overall, and you’ll feel fantastic every time you pay anything off fully.

Invest if you are able to

Invest if you are able to

You will have more money that you can spend or invest. Only by investing can you develop wealth, and you should make it a habit. To get started, you don’t need a lot of money. Simply be willing to learn about the benefits of wise investments and how to get started. Take advantage of the available money compounding chances and invest the surplus income.

Finance books should be read

Perhaps this is the one advantage the wealthy have over the less fortunate. They were reading. Nobody could have greater financial knowledge than you if you put your heart and mind into building your nest egg.

It goes beyond whatever official education you may have received. You must first learn to teach and then invest in yourself. This is how you educate yourself on how to become wealthier.

You must log in to post a comment.