At the start of a new year, (or at any other time!) it’s natural to reassess what we want out of life and how to make it happen.

Some goals, like losing weight, are easy to grasp, even if achieving them requires some dedication or will-power! But there are other things like ‘sorting a pension’ that we know we should be doing, but the goal is more abstract and hard to pin down.

We know there will come a point in our lives when we can no longer work, and we will rely on our life-savings to provide an income in our old age.

But how much should we be saving?

It’s a difficult question but one that Profile Pension’s new calculator is here to help answer.

According to a recent study by the Pension and Lifetime Savings Association (PLSA), 80% of us are confused about whether we’re on track for retirement.

Personally, I knew I should be saving for my retirement and I started contributing to a pension with my first job after university, but I didn’t know how much I really needed to save and just picked a figure out of thin air and promised myself I would look into it in the future. Maybe you have done the same?

If you’re unsure how much you need for retirement be sure to read on…

You Might Need More Than The State Pension

You Might Need More Than The State Pension

In the UK, the state pension provides a basic level of income in retirement (now from age 67 but it will increase in future years). There have been lots of changes to the state pension in recent years but moving forward the full new State Pension is currently £164.35 per week.

It’s important to note that you have fewer than 35 qualifying years (if you took any time off work and didn’t pay National Insurance contributions) then your state pension will be reduced but you might be able to top up by paying voluntary National Insurance contributions. More information on this can be found on the gov.uk website.

Could you live on £164 a week?

Even if you have a full National Insurance record and are entitled to the full State Pension, could you live on £164 a week? For most of us, that will be not be enough to provide a sufficient income to live the lifestyle we want in retirement so we will need to set up our own private pensions and/or contribute to any pension policies we get through our employment.

How To Work Out What Is Needed

Retirement planning can be difficult because the destination is either so far away that it is hard to imagine what life might be like 30 or more years into the future, or retirement is approaching fast and the prospect of saving a huge nest-egg becomes too daunting, or simply impossible. But wherever you are in the journey, it is worth taking some time to think about how much you can save for the future.

Regardless of how far away retirement might be for you, getting an understanding of the numbers now, and how much you might need is incredibly powerful.

Once you have an idea of what you might need, you can start budgeting according to fund your future retirement.

So, how do you start?

Enter Profile Pensions’ Pension Calculator

I’m pleased to share a really helpful pension calculator created by Profile Pensions to guide you through thinking about what you might need for retirement.

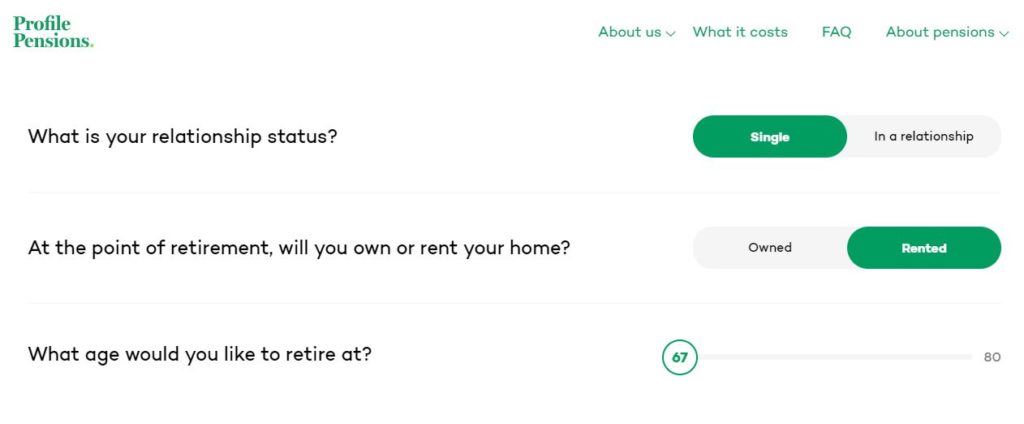

The calculator requires your answers to three basic questions:

- Your relationship status

- If you plan to own a home or rent in retirement

- The age you intend to retire

Don’t worry if you don’t know the answers, you can change them to see how your choices affect the final results.

Once you can answered the questions, the tool shows you how much income you might need in retirement, and then shows you how much total savings you need to have by your retirement age to generate that income.

When I used the tool, it told me that for a ‘Modest’ lifestyle, I would need a total pension of £t the point of retirement, and for a ‘Comfortable’ retirement, I would need a total pension of £

My Thoughts on the Calculator

The calculator is really simple to use and quickly provides a helpful idea of how much I needed the value of my pension pot to be for a modest and comfortable lifestyle in retirement.

However, the tool is only as good as the assumptions it uses, and the set assumptions don’t apply to everyone, so your requirements could be very different in reality. My advice would be to use the calculator as a starting point, not to find a definite answer. For a definite answer you might need to do some more advanced calculations in Excel or speak with a professional Financial Adviser for more detailed projections.

That said, the simplicity of the calculator is helpful for getting started, though I do have two suggestions on my wishlist:

1. Turning A Pension Pot Into An Income

1. Turning A Pension Pot Into An Income

Unless you have a pension that promises you a certain income, like a teacher’s or a doctor’s pension that pays out a percentage of your salary for each year you’ve worked (known as a defined benefit pension), then it’s likely that you will have a pension policy that is simply a pot of money/investments that you can add to each month or each year and hopefully it grows over time based on the investments held within the pension (known as a defined contribution pension).

At retirement you then need to use that money in the pension to provide an income, some of which can be taken tax-free and the rest is taxable.

The calculator assumes you will use all of the money saved (with no tax-free cash taken) in the pension policy to buy an ‘annuity’, an insurance product where you pay a lump sum to an annuity provider who then promises to pay you an income until you die.

Annuities can be good for peace of mind, knowing you are not going to run out of money before you die, but the rates are typically lower than ever, meaning you have to pay a lot for the promise of a relatively low income.

For example, depending on your age and circumstances you could pay £100,000 to buy an income of £3,000 a year. For many retirees the annuity option is not appealing as they prefer to take some of the money out of their pension pots to top up their income when needed, and leave the rest of their pension savings invested so it can hopefully continue to grow.

This is known as ‘pension drawdown’.

It is a less certain way of providing an income in retirement because the money could run out if the investments don’t do well or the withdrawals are too high (!), but it does provide more flexibility in how much income is taken each year, and if the investments do well, can result in a higher income from a smaller pension pot – which can be reassuring to those who have not managed to save much for their retirement yet and don’t think they can reach their retirement goal.

My ideal pension calculator would therefore include both the annuity option (which the calculator currently is based on), and a drawdown option which, if you are willing to accept more uncertainty, could mean a smaller pension pot target.

2. How much do I need to save to reach the pension goal?

The calculator shows how much I need my pension to be worth but does not show how to get there – how much do I need to save each month and how much do I need the underlying investments to grow by to reach my income goal?

My ideal calculator would have both the final number (which the current calculator has) and a monthly or annual amount for what is needed to achieve the final number. This savings number would be calculated using various assumptions including investment growth rate and charges and how much these things affects the final result. By providing both sets of numbers, the final amount and the estimated monthly contribution required, the calculator could help answer more complicated questions like is it worth working more and saving less, or vice versa. For example, this could help people decide if working for one extra year could mean not having to find so much in the monthly budget to save for retirement.

So How Much Is Enough?

I encourage you to use the calculator and take the answers it provides to help you think more about what you need to save for your golden years.

Once you’ve had a go, don’t be discouraged if the number is much higher than you think. When you invest in a pension, most of the time the money doesn’t sit in cash, but rather, it goes into investments that should hopefully grow faster than inflation, helping you to reach your retirement goal. Also, the amount of income you need is very personal and everyone will have different needs and aspirations for their retirement.

You may think you will need a similar income in retirement to what you earn now, or even more if you want to travel the world in luxury in your golden years. If so, then get saving hard. But perhaps you may crave a simple, low cost life that doesn’t require the latest fashions and daily coffee shop lattes, so your retirement saving goal may be less.

You should also consider that spending needs rarely stay the same over the years. For many, the early years of retirement means higher spending as they have the time to travel and do all the things they never had time to do during their working years. This ‘spendy’ period then often transitions to a quieter, more frugal time as life slows down – perhaps health or mobility issues curtail the amount of travel that’s possible, or the idea of staying comfortable at home has a bigger appeal than travelling, with creature comforts at home being more preferable to lavish hotels and room service. Then, finally, for an unlucky some, costs can start of go up again in later retirement if long-term care is needed.

The Power of Planning

By taking the time to assess your retirement savings, the exercise can either provide the peace of mind of knowing that you’re on track or it can light a fire within you to change the trajectory of your financial life. You may even wish to over-save so you can leave a financial legacy to your family. Hopefully this calculator will help you dream and realise how much is possible for you.

Happy planning!

This post is a collaboration with Profile Pensions whose mission is to help everyone in the UK better understand their pension(s), allowing them to be more informed and ultimately better off in retirement. They provide impartial, expert and ongoing pension advice. Capital at risk.

You must log in to post a comment.