One of the most fundamental pieces of a good personal finance system is being able to pay your bills.

One of the most fundamental pieces of a good personal finance system is being able to pay your bills.

It’s great (and might be fun for some) to research the latest investment trends, or try to save money here or there, or find ways to earn extra money, but ultimately if you haven’t got a handle on your household bills then all your other plans are going to be affected.

Being good with money (and anything really) is all about having a general awareness of your situation at all times and being able to focus when it matters.

When it comes to money, I’ve been both good and bad. When my money-life was good, I naturally wanted to focus on it more, by being organised and tracking my savings and expenses, but when my money-life was bad, I wanted to bury my head in the sand and deal with it later…which doesn’t improve the situation by the way!

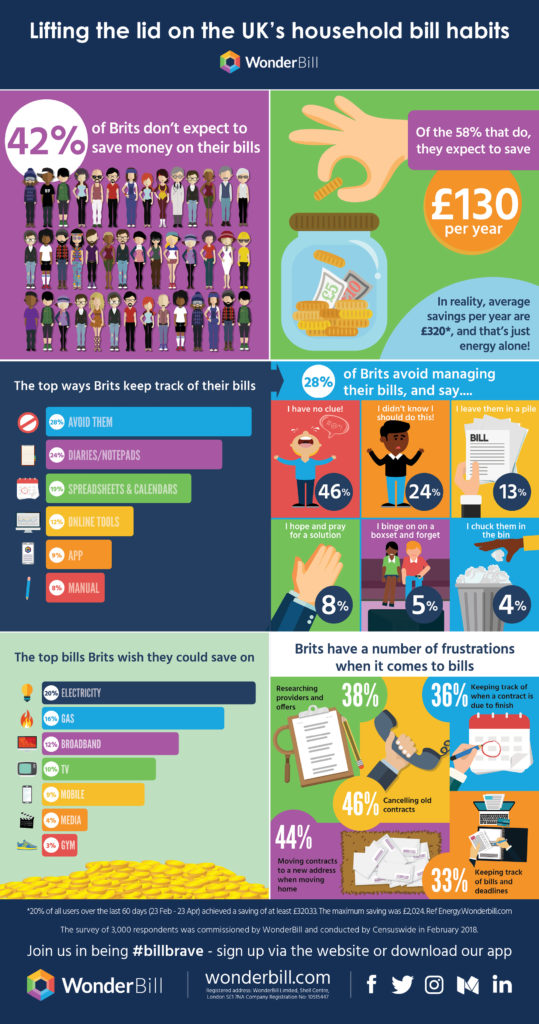

A recent survey of 3000 Brits in February revealed that I was far from alone in wanting to avoid dealing with bills – 32% of survey participants admitted to ‘managing’ their bills through things like binge watching Netflix to forget about them, ‘hoping for a miracle’, ‘praying for an answer’ or using the ‘old filing method’ of throwing them straight into the bin.

I’ve certainly done a few of those things in the past!

Do you have a system for managing bills? Is it working for you?

Do you have a system for managing bills? Is it working for you?

The majority of respondents (67%) do keep track of bills, but almost half (43%) use manual methods like notebooks, calendars or diaries. Such methods can certainly work but they can be time-consuming and it’s easy to make a mistake. Thankfully now there are apps and online tools that take much of the work of bill-tracking and keeping organised.

One such app I’ve been trying out recently is called WonderBill, and it was so easy to get my bills set up in the app. You simply log-in to your household bill accounts, and you can even add any bill you like, including rent! For example, I connected the app to my internet provider’s online account, so the app can pull through my internet bill automatically, or as it felt like, auto-magically!

I’ve used the Android app on my phone downloaded from the Playstore by searching ‘Wonderbill’ and the desktop version at https://my.wonderbill.com. It’s also available on iOS from the App Store.

I liked that it was easy to get the information into the app, it didn’t feel like a chore, and the integration with companies I already use like my internet and energy provider was really smart. There’s 67 providers available so far and more are being added all the time. I now have a history of all my different bills and the app even shows me where I could potentially save money based on my actual bills!

Awareness is Everything

Being on top of your bills not only helps you avoid paying them late, but you’ll more likely notice opportunities to save money when you come across new deals. I see my bill amounts in the app all the time so I can instantly spot bargains when I’m out and about. For example, if I saw an internet company deal on TV I’d know if it was worth switching or not because the bill-tracking app has raised my level of awareness of what I’m paying each month without having to rummage through envelopes or having to check through all my different accounts and direct debits.

If you’re going through a tough time with money, and even if you’re not but you feel you could be a bit more organised with knowing where you stand when it comes to your bills and expenses, you could benefit by trying something new like WonderBill.

It can be a completely natural reaction to want to bury your head in the sand or just ‘get by’, but there’s so much to be gained by being more in control of your bills. Not only can you plan your finances better, it gives you the mental space to dream bigger and be able to focus more on the more important things in life as you know you’ve got the basics covered.

You must log in to post a comment.