Investing in commercial property overseas can bring about a variety of different benefits, but it also comes with a range of risks and potential problems that may threaten to derail all of your hard work. It’s not as easy as purchasing a property that’s in a familiar location nearby, as each country has its own set of rules and guidelines that you must follow when investing in commercial premises, and you may even face a fine or penalty charge if you fail to abide by the law.

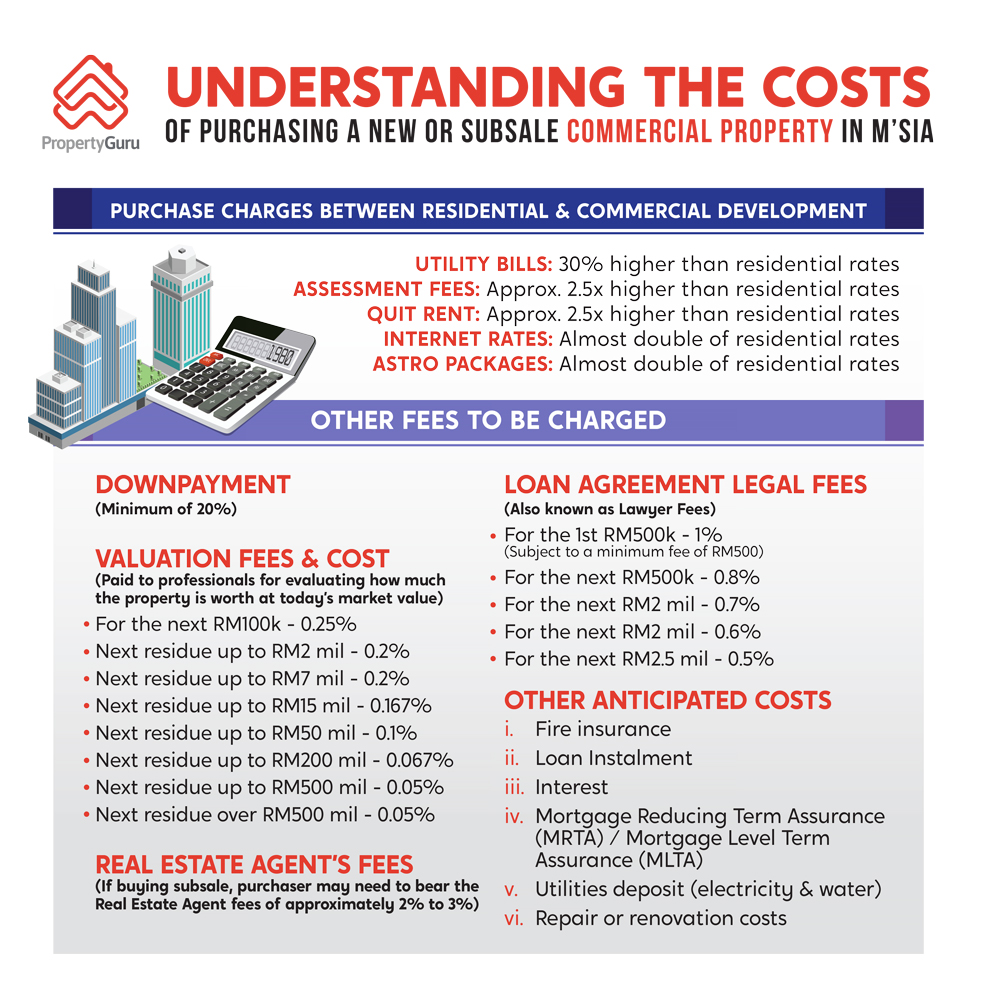

It’s important to know the costs associated with buying commercial property overseas, as you need to prepare yourself financially for what lies ahead. Encountering unexpected fees could put your project in danger of failing, so it’s a good idea to perform in depth research in order to plan for every possible occurrence. The first and likely the largest cost that you need to consider is the down payment or deposit, which in countries like Malaysia must be a minimum of 20%. You’ll also need to cover estate agent and legal fees, loan agreements and potentially repair or renovation costs, so be sure to factor these into the equation. If you find that you don’t have the money you need to perform each and every task, then do not go ahead with your purchase.

It needn’t be difficult to learn more about the costs associated with buying commercial property overseas, as this handy infographic explains what you can expect to pay when investing in Malaysia.

Infographic Design By PropertyGuru Malaysia

You must log in to post a comment.