It’s almost guaranteed that stocks and shares are the first things that pop into your head when you think of investing. And that’s unsurprising. It’s become almost too easy for the average joe to make money investing in the stock market. But it’s a fickle beast. Sooner or later, the market will take a downward turn. And that’ll leave investors scrambling for alternative ways to make money.

It’s almost guaranteed that stocks and shares are the first things that pop into your head when you think of investing. And that’s unsurprising. It’s become almost too easy for the average joe to make money investing in the stock market. But it’s a fickle beast. Sooner or later, the market will take a downward turn. And that’ll leave investors scrambling for alternative ways to make money.

So whilst they’re still preoccupied with the stock market, it gives you an opportunity. Now’s the time to exploring new ways to invest your money to take advantage of the underpopulated markets. And just because they’re alternative ways doesn’t mean they’re a gamble. All of the suggestions we have for you have been viable investment solutions for years. But they’re largely untapped by the general population.

-

Peer-To-Peer Lending

Peer-To-Peer Lending

Peer-to-Peer (P2P) lending is one of those scary-sounding investments. But it’s actually more straightforward than you’d think. And it’s still a pretty new phenomenon, so there’s little competition amongst the general populace.

Simply, online P2P services offer loans for personal use, businesses, and pretty much everything, including the kitchen sink. To get in on the action, you join a pool of investors who are willing to loan money to others. Once the borrower qualifies for the loan, you fund it. Simple. And there are plenty of platforms to choose from, like LendingClub, Prosper, and Peerform.

P2P lending takes out the middle man, the banker. Which means a higher return for the investor, you. And lower rates and fees for the borrower. And the beauty of P2P is that you can get a diverse loan portfolio. So if you invest £20k, that can be spread over numerous loans. Having this sort of diversity means that if one loan goes sour, you still have plenty of others to keep your portfolio afloat.

-

Real Estate

Real Estate

Real estate investing is indeed tried and tested. You can buy property and rent it out. Or you can purchase it cheaply, give the house a new lease of life, and sell it on for big profits. In many cases, you don’t even need the total amount of money. You can put a down payment, and the banks will sort out the rest.

Before entering the real estate world, though, ask yourself if you’ve got what it takes. Particularly if you’re going to end up being a landlord. It can bring complications and headaches with it. Things break, and people fall behind on rental payments, just to name a few. So consider whether you’d be able to deal with these headaches before investing.

You can hire professional help with a property investment company like Track Capital. Or you can get a property management company in which will take care of landlord responsibilities if you won’t be able to handle them.

-

Precious Metals

Precious Metals

Precious metals, gold, in particular, are worth an investment. But they can be controversial. For some, they work as investments like clockwork. But for others, they become a nightmare. Like any investment, precious metals actually fall somewhere in the middle.

What makes them so controversial is the fact that the price of them rises and falls alongside currency. When it’s strong, so are the metals. But when it’s weak, they fail. Sometimes dramatically so. And it’s almost impossible to predict when these rises and falls might happen. It’s a good idea to keep an eye on currency trends and always have some precious metals in your arsenal. One of the significant benefits, though, is that you actually own the investment. And you can hold onto it until your get the best possible return.

-

Collectibles

Collectibles

Collectibles, like antiques, artworks, and other treasures, are much like stocks. Sometimes you win big, and sometimes you don’t. But you should approach collectible investments with caution. They will require you to have some knowledge and know-how. You can’t just buy anything and everything you see; you need to know what to look for. And when something is a diamond in the rough and when it’s just coal.

The entire market is based on what people are willing to pay for the collectibles. If you’re a collectible investor worth their salt, you’ll have a good idea of what’s desirable and what you should pass up. So it’s a good idea to specialise. Whether that’s first editions of books or little-known artworks and artists. The best way to approach collectible investment is to focus on something you actually want to own. That way, you won’t be too crushed if you have to hold onto the for a while until the right buyer comes up.

-

Yourself

Yourself

The greatest investment you can make is in yourself. And that doesn’t just mean starting your own business. There are oodles of ways to invest in you. It could be that you take courses that make you more desirable to employers so you can barter for a better salary. You could take on more significant responsibilities in work that make you invaluable to your employer. It could even be that you simply spend more time researching investments, so you become a leading figure.

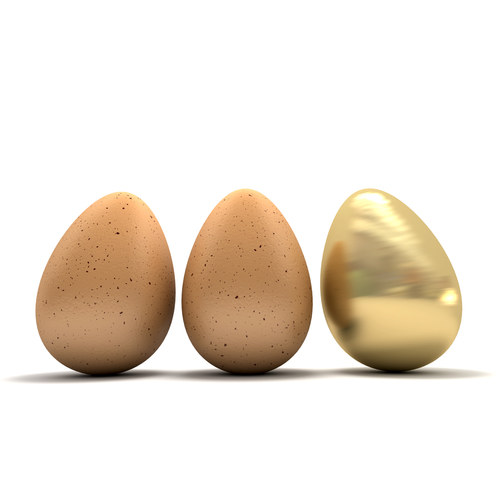

Of course, you can just invest in yourself by building your own business. If you’ve got the idea and some capital to start, there’s no reason to hold back. Remember; don’t put all your eggs in one basket. Put some money into your business and invest the rest elsewhere for the highest returns possible.

You must log in to post a comment.